Less Supply = Higher Priced Homes

Home builders are selling half the homes but are twice as happy (partying like it’s 2005 happy), reports the Wall Street Journal. The number of builders surviving the ‘08 crash are the few and primarily Wall Street listed. Many pesky privately-owned firms fell down and couldn’t get up.

Those left, “are facing rising costs for both materials and labor, another factor that should dim their euphoria,” reports the WSJ. Justin Lahart writes,

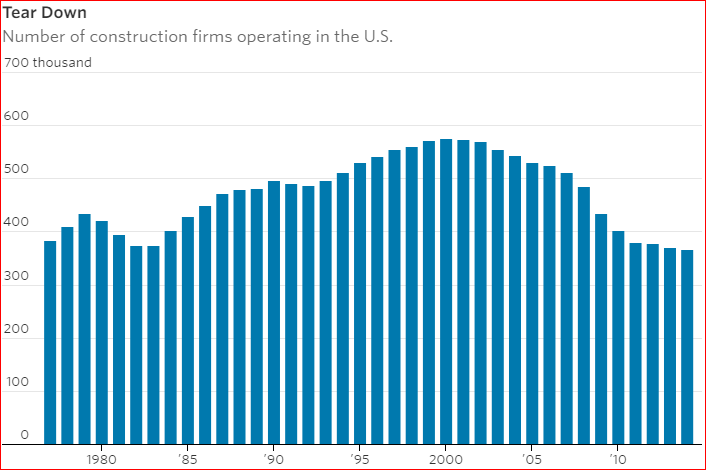

By the Commerce Department’s count, there were about 368,000 construction firms operating in the U.S. as of 2014 (the last year with available data). That compares with about 530,000 in 2005, and is the lowest number on record going back to 1977. The Labor Department reports that there are now 763,000 workers involved in the construction of residential buildings, compared with 996,000 at the end of 2005.

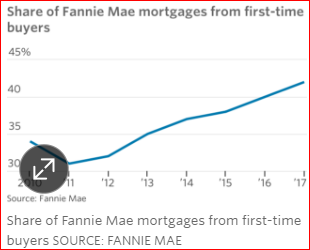

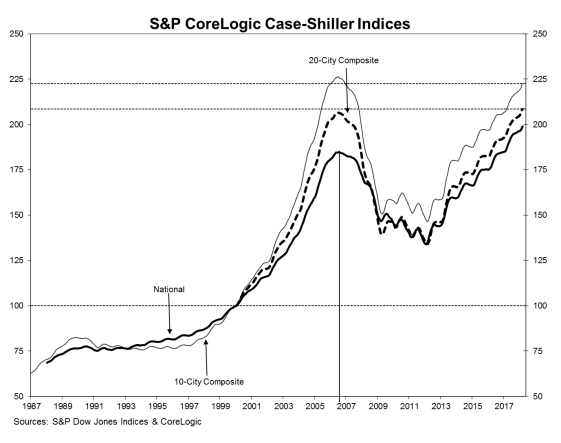

However, the shortage of supply, increases in costs, and millennials finally catching the home ownership bug has median prices jumping. Nationwide, “the median was $316,200 last year versus $240,900 in 2005.”

Here in Vegas the March new-home median was $329,900 and is on its way to breaking this market’s median price record. Dennis Smith writes that subcontractors are already stretched to the limit. Imagine when the Raiders stadium job gets underway. The Business Press reports Summerlin sold land for $697,000 per acre in the first quarter.

Smith indicates there is only 2.1 months worth of residential inventory on the market. “A normal supply is supposed to be 6 months,” he writes.

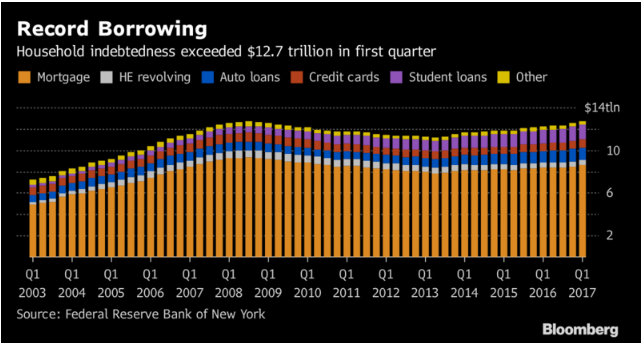

All this tightness in a town full of squatters. Smith explains,

There are still tens of thousands of mortgages underwater, and those owners are “locked into their homes” or have stopped making payments and are living “free” until the mortgage servicer decides to process the default. There is no telling how long that will take, as there is still no real incentive for the mortgage servicers to do this. The number of homes going to auction has been flat since the end of the Great Recession, and the majority of those that do go to auction, go back to the servicer. In addition, there haven’t been enough new homes built in the last 10 years to replace the depleted existing home supply. Thus, the inventory of available homes for sale looks like it will remain near the 2 – 3 month supply for some time. It is possible that by the end of 2017, we may see less than a 2-month supply of SFR listings.