Navigating Booms and Busts

The everything bubble continues with a Monet landscape going for a record $110.7 million. Katya Kazakina wrote on Bloomberg, “Painted in 1890, ‘Les Meules,’ from the artist’s series featuring haystacks, had been estimated [to sell] at $55 million. The final price includes fees.”

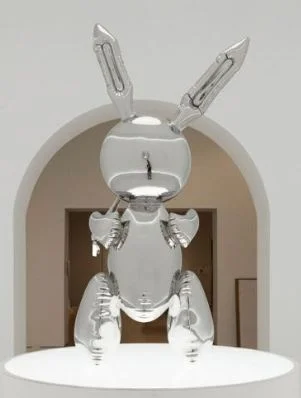

Six bidders took the price from $45 million to $97 million in all of eight minutes. The winner was not identified. Another conspicuous consumption art purchase made the record books with hedge fund titan Steve Cohen paying $91 million for Jeff Koons’ Bunny Sculpture. The highest price paid for an art piece by a living artist.

Ms. Kazakina, again covering the art beat for Bloomberg, reported,

The stainless steel, 3-foot-tall inflatable bunny was part of a group of works consigned by the family of late media mogul Si Newhouse.

Art collectors and investors shelled out more than $2 billion over five days of auctions in New York last week.

A new second edition of Vikram Mansharamani’s “Boombustology: Spotting Financial Bubbles Before They Burst” was just released and and the author writes of the late 1980’s art boom fueled by Japanese buyers.

Mansharamani captures the animal spirit of the live auction.

Anyone who has witnessed a live auction in which bidding far exceeds pre-auction estimates or sets a new world-record price understands that there is something curious in the air. --something electric, something indescribable, something magical. I believe that “something” is confidence, perhaps even overconfidence.

The Harvard lecturer highlights auctioneer Sotheby’s (BID) stock price as a bubble indicator. If accurate, the bloom has come of the current boom, and we just don’t know it. BID is trading just north of $37, after hitting a high off $56 plus, in July 2017. Art Strategy Partners co-founder Wendy Battleson told Almost Daily Grant’s,

Ultimately that great piece of business that Sotheby’s is raving about is probably a loss leader and in a best-case scenario is probably breakeven. Good news at Sotheby’s means very bad news for their stock price.

Mansharamani’s second edition has all the great insights from the first edition plus a forward by James Grant, a chronicling of the Bitcoin rise and fall, a discussion of quantitative easing and a new addendum on passive investing. In 2011, I wrote on Mises,org,

the author looks to the Austrians for the greater part of his macroeconomic perspective (along with Hyman Minsky), leading with a quote from Mises and quickly recognizing fractional reserves and central banking as culprits in bubble creation. Mansharamani uses the work of Roger Garrison to great effect. Those who have seen the Mises Institute's business-cycle T-shirt will recognize the graphical representation of malinvestment through low interest rates pioneered by Garrison.

Mansharamani uses more than economics to examine booms and busts. He also applies psychology, biology, and politics.

Mansharamani believes Minsky’s work dovetails with that of the Austrians. While not an Austrian sympathizer, Minsky did study under Joseph Schumpeter. John Law scholar Antoin Murphy offered the Minsky/Kindleberger sequence of events characterizing a stock market boom and bust, which I cited in chapter one of “Early Speculative Bubbles and Increases in the Supply of Money.”

Minsky believed market stability breeds instability. Debt structures, in Minsky’s view, go from hedge, to speculative, and ultimately to what he termed as, Ponzi. Hedge financing means a borrower can service interest and principal with cash flow. With speculative finance, the borrower can pay interest from existing cash flow, but must refinance the principal. Finally, in Ponzi finance, the borrower depends upon refinancing to pay both interest and principal.

Boom times cause lenders to first make more and more speculative financing, and then graduate to Ponzi finance before it all comes crashing down. The author quotes Minsky. “Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is a large weight of units engaged in speculative and Ponzi finance.”

This is all academic parlance for lenders shifting from being tight to loose. The author dubs this Minsky Migration, with the ultimate climax being what Paul McCulley termed a Minsky Moment. Stephanie Pomboy, head of MacroMavens, says three-quarters of S&P 500 earnings come from only 20 percent of the companies. According to Pomboy,there is a real question whether the rest can make debt service payments, especially if rates rise. From that, we can reasonably guess we are well into the speculative phase of finance and close to the Ponzi stage.

Which brings us to the Austrian Business Cycle. Mansharamani writes that ABC “suggests that overinvestment and excess capacity create conditions that become highly unsustainable and eventually result in a bust.”

However, Austrians would say it is not overinvestment, but malinvestment, which creates the conditions for the required bust to cleanse this misdirection of capital.

If the separation of gold and money hadn’t made investing treacherous enough, that default has led to the era of ZIRP, Operation Twist, QE, QT and other central bank shenanigans. Now, that monetary policy monster may give way to Modern Monetary Theory (MMT). Proponents of MMT are Keynesians with a greater imagination. They say budgets and deficits don’t matter, print what you need, early and often. Inflation is dead they say.

Inflation is far from dead. Asset bubbles are where the money created out of nowhere has gone. “Boombustology” is your survival manual for the central bank created speculative house of mirrors, which may become more freakish.