Her story is pure Cinderella in terms of table success, making her book compelling from start to finish. But, “Bluff” is not just a telling of “bad beats,” “bluffs,” and “big pots.” Konnikova weaves plenty of psychology and behavioral economics into her narrative.

All in Book Review

Genius: Mises v. Trump

To understand the president, Rucker and Leonnig, provide the essential roadmap to the method of Trump’s madness.

More Financial Doom on the Way

His simple conclusion is “Runaway private debt and the resulting overcapacity does a better job than any other variable in explaining and predicting financial crises.” The author’s only mention of business cycle theory is to give a hat tip to Hyman Minsky’s devolution of loan quality during the boom phase from “hedge” to “speculative” to “Ponzi.”

The Creator of the Trump Presidency.

Since Ailes’s passing in 2017, Fox has still been Trump TV, but lately, the network hasn’t been Trump enough for the President, who recently tweeted “We have to start looking for a new News Outlet. Fox isn’t working for us anymore!”

White Collar Welfare

Her account, “Washington Siren: A Woman’s journey through scathing scandals, lies, and secrets inside the FDIC, HUD, IRS and other agencies, with a love story that survives it all.” written, for some reason in the 3rd person, chronicles O’Toole’s long career of Sisyphean frustration with government bureaucracy.

"Regulating" Boom and Bust

After IndyMac, Bovenzi points out over 400 banks would fail over the next four years. Why is it when one bank fails, despite FDIC insurance and other government interference, numerous other institutions often go bust?

Bookmaker With the Mind of Mencken

The Sharps, dedicated to making money, show up and bet against the line when it appears fresh and ripe for the picking. The Squares bet the picked over and massaged point spreads and odds with their hearts on their sleeves.

A Fighting Chance with Jr. Mining Shares

Parking shiny coins in a safe deposit box may not provide the excitement that FAANG investors are used to. For those with a strong stomach speculating in junior mining shares provides maximum leverage to gold’s price--up and down. For the past decade, it’s been mostly down and painful.

Navigating Booms and Busts

Boom times cause lenders to first make more and more speculative financing, and then graduate to Ponzi finance before it all comes crashing down. The author quotes Minsky. “Over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is a large weight of units engaged in speculative and Ponzi finance.”

The Battle for Sound Money

Elvira’s gold buying makes me think she has read Saifedean Ammous’s “The Bitcoin Standard: The Decentralized Alternative to Central Banking.” Don’t let the title fool you. This book is not the cover-to-cover crypto cheerleading/gold bashing other authors attempt to jam down our throats. Dr. Ammous Is actually a Professor of Economics, and none other than “Black Swan” author Nassim Taleb wrote the introduction.

THE GAME OF BANK BARGAINS

“Fragile By Design” is a big book, and while it looks at banking systems in other countries, the authors devote many pages to the 2008 crash in the U.S. But first, they make the important point that bank failure losses used to be borne by bank owners and depositors. Of course, now, with government overseeing the operation, costs have been shifted to taxpayers, in what the authors call “The Game of Bank Bargains.”

The Value of Work

Gill’s book, “How Starbucks Saved My Life: A Son of Privilege Learns to Live Like Everyone Else” is a love letter to Starbucks’ employees and customers in between ruminations about his childhood, career, and past mistakes that left him an unemployed, broke white man in his early 60’s.

Trump's Gut Feeling

The fact is, our bodies react to news and risks quicker than our brains do. Conscious thought is left in the dust when we react and especially when we take risks. Of course neoclassical economists would poo-poo the notion of our bodies reacting to threats and risks, after all, we’re all rational beings, doing what’s rational at all times. Yeah, right.

The Old Fashioned Fed Chair

Trump would like Volcker’s height, 6 foot 7 inches, as opposed to Janet Yellen, who was fired for her lack of it, at 5 foot 3 inches. However, while Trump has his eye on the stock market, Volcker always kept his on the price of gold. The ex-Fed Chair mentions the yellow metal often in “Keeping at It: The Quest for Sound Money and Good Government.”

Dicey Bloated Government

This time, Lewis manages to find diligent, creative federal government employees (he had two million to choose from) to tell the story of Trump’s transition, or lack thereof. The thesis is, we are all at risk due to the President’s neglect. Legions of earnest federal workers were ready to smoothly hand over the monstrosity that is the federal government, and, well, no one showed up.

The NFL: Land of the Caligulas

It is “the Membership,” who are the “puffed-up billionaires who own the store,” writes Leibovich. “These are the freaks, the club that Trump couldn’t crack.” On the next page, the author refers to the Membership as “bespoke Caligulas.” He goes on about how much TV time the owners receive as “presiding plutocrats.”

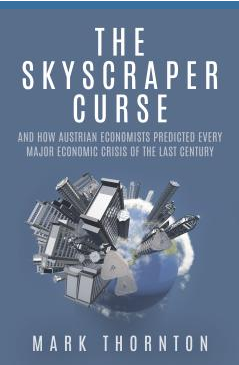

Tall Buildings, Mighty Crashes

Mark Thornton’s “The Skyscraper Curse: And How Austrian Economists Predicted Every Major Economic Crisis of the Last Century” couldn’t be more timely. As we slide from boom to bust, the thoughtful and curious will want answers. Thornton has them.

Kirk Kerkorian: Misesian Entrepreneur

Kerkorian began his art early, by necessity. “When you’re a self-made man you start very early in life…,” Kerkorian said. “You get a drive that’s a little different, maybe a little stronger, than somebody who inherited.” Unlike a certain president of the United States we know. Rempel starts his first chapter with a quote from Mark Twain, “Necessity is the mother of taking chances.”

An Anointed Son, A Reporter Scorned

Dana Gentry’s “The Anointed Son: A True Story of Greed, Power and Blind Trust” is a book, not about low rates, but high ones. While the prime lending rate was 4 percent in 2003, Las Vegas real estate developers would borrow at rates of 12 percent up to 15 percent in pursuit of cashing in on the real estate boom.

Education: Expensive Signaling

Caplan explains, “Graduation tells employers, ‘I take social norms seriously--and have the brains and work ethic to comply’ Quitting tells employers, ‘I scorn social norms--or lack the brains and work ethic to comply.’”