Trading Bad Paper Helps Underwater Homeowners

Goldman Sachs is buying up Fannie Mae’s bad paper to the tune of $4.5 billion for $5.7billion worth of mortgages since 2015, reports the Wall Street Journal.

Goldman has purchased 59% of the Fannie Mae auctions and “nearly swept the last two auctions, held in October and earlier this month, acquiring 15,000 individual loans representing $2.8 billion in unpaid balances.”

Liz Hoffman and Serena Ng write,

Its aggressive bidding has raised eyebrows among competitors and was much talked about on the sidelines of a recent securitization-industry conference in Las Vegas, according to attendees.

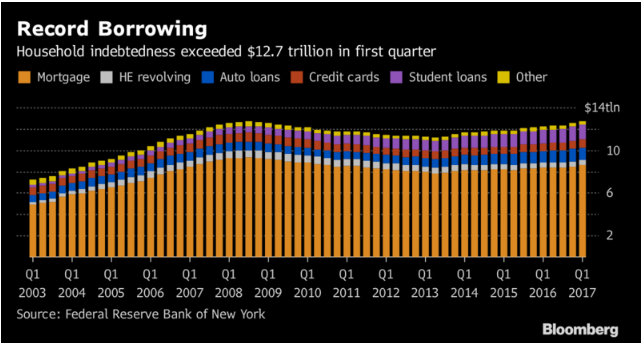

Goldman has paid between 50 and 90 cents on the dollar for the loans, according to Fannie Mae records. A steady rise in home prices has increased the cost of buying delinquent loans in recent years—but also the potential profit if Goldman can resell them or foreclose on the property.

The Wall Street mega-bank is aggressive as it looks to settle its $5.1 billion penalty from regulators for the housing debacle and restructuring these loans counts toward $1.8 billion of the settlement.

Any relief they provide homeowners is money they don’t have to hand over to Uncle Sam.

In the short term Gov’t Sachs is looking to satisfy its debt to society, but in the long run they think they can make some money at this. Laurie Goodman agrees. She is the co-director of the Housing Finance Policy Center at Urban Institute, a Washington, D.C.-based think tank. “Buying non-performing loans and modifying them is a profitable business.” Goodman says.

I wrote in a piece that appeared on TownHall in 2012, “The real help for underwater homeowners will only arrive when Fannie, Freddie, and the rest are allowed to fail. The equivalent of a chapter 7 bankruptcy filing (liquidation) would put these underwater loans out for bid in the market place.”

Buyers of the paper, like Goldman Sachs is doing immediately negotiate with borrowers to create loans that are conforming (80 percent LTV) and performing.

I pointed to Lewis Ranieri’s (of “Liar's Poker” fame) Selene Residential Mortgage Opportunity Fund that had purchased a mortgage secured by the home in St. George, Utah, for a deep discount, the Wall Street Journal reported in a front-page story. The borrowers were struggling with a $3,464 monthly payment and the value of their home had plummeted.

Selene, reported the WSJ,

buys loans to make a profit on them, not as a public service, but company officials say it is often more profitable to keep the borrower in the home than to foreclose. If a delinquent loan can be turned into a "performing" loan, with the borrower making regular payments, the value of that loan rises, and Selene can turn around and either refinance it or sell it at a profit.

"Around 90% of Selene's loan modifications involve reducing the principal," James R. Hagerty wrote in the WSJ, "compared to less than 2% of the modifications done by federally regulated banks in the first quarter."

At the time, most upside-down borrowers couldn't find a human to talk to about their loan, let alone sit down and renegotiate terms that would benefit both parties. However, Selene immediately contacted the borrowers on the notes they have purchased, "sometimes sending a FedEx package with a gift card that can be activated only if the borrower calls a Selene debt-workout specialist."

What Goldman is now doing proves the point, there is no middle way to solve the housing crisis. For capitalism to work its magic and set underwater homeowners free, lenders must be allowed to fail, allowing mortgages to trade at market clearing prices.