Buyers Buy, When Lenders Lend

Spring is in the air and homebuilders have the wind at their backs. According to HousingWire and a report from Fannie Mae, “Consumers’ faith in the housing market is stronger than it’s ever been before.”

For those who remember the boom days of 2002 to 2007, when people couldn’t buy enough houses, the following is hard to believe: “According to the Fannie Mae report, the Home Purchase Sentiment Index increased by 5.6 percentage points in February to 88.3, setting a new all-time high.” Then we read a little further.

Doug Duncan, chief economist for Fannie Mae, seems to credit this sentiment bump to Trump. “The latest post-election surge in optimism puts the HPSI at its highest level since its starting point in 2011. Millennials showed especially strong increases in job confidence and income gains, a necessary precursor for increased housing demand from first-time homebuyers.” The HPSI began life near the bottom of the market in 2011.

So why the rosy scenario? Americans figure the coast is clear, their jobs are safe, America is gonna be great again. “The net share of Americans who say they are not concerned about losing their job rose 9 percentage points to a new survey high of 78%.”

But buying a house is all about interest rates, which look to be heading up. No problem. Kelsey Rimirez writes, “ title and real estate professionals responded that rates would have to hit 5.4% before homebuyers would be discouraged from entering the market.” That’s more than 100 basis points north of where rates are today.

Here in Las Vegas homebuilders are rockin’, “We match our high for 2017 this past week with 0.9 net sales per project,” writes Andrew Smith of Homebuilders Research. “ Buyer traffic also remained ‘good’ at over 18 ‘buying units’ per project for the week.”

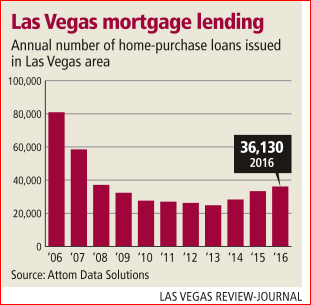

And lenders are learning to say “yes” again. Last year over 36,000 purchase money mortgages were made in Las Vegas a far cry from the 81,000 purchase loans which were originated in 2006. But, a considerable improvement over the 24,800 in 2013.