Housing: Rates Up, Demand Down

The 10-year treasury yield burst through 3 percent convincingly (closed at 3.078% today) and no one seems to give a hoot because the DJIA popped 250+, so all is hunky-dory in the land of Trump-o-nomics.

The increase in the 10-year gives Jerome Powell room to raise the Fed Funds rate and avoid the dreaded inverted yield curve. Wolf Richter of wolfstreet.com fame believes the market’s acceptance of the 3 percent level sets up the next leap to 4 percent.

Mortgage rates ended last week at 4.88 percent before the 10 year’s pop, so we’re on the verge of 5 percent mortgage rates, the highest since 2010. A 4 percent 10-year will mean 6 percent mortgages and rates haven’t been that high since the bubbly days of 2006-2008.

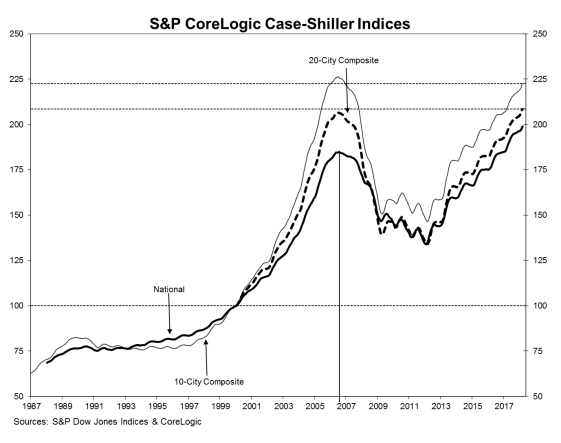

In 2010 the Case-Shiller 20 city home price index was just short of 146. Today, the index stands at just over 213, a 46 percent increase from 8 years ago. Richter writes,

Potential homebuyers next year haven’t quite done the math yet what those higher rates, applied to home prices that have been inflated by 10 years of interest rate repression, will do to their willingness and ability to buy anything at those prices, but they’ll get around to it.

S&P Dow Jones Indices reported at the end of August,

In June, Las Vegas led the way with a 13.0% year-over-year price increase, followed by Seattle with a 12.8% increase and San Francisco with a 10.7% increase. Six of the 20 cities reported greater price increases in the year ending June 2018 versus the year ending May 2018.

At the beginning of 2010, Las Vegas’s Case-Shiller index stood at 104. This June it was 183.55, an increase of 76 percent. At the market low point in March 2012, the Las Vegas price index number was 89.87. Home prices in Vegas have more than doubled in 6 years.according to Case-Shiller.

All indicators have been red-hot in Sin City, with less than 2 months of available resale homes on the market, prices screaming upward, the Golden Knights playing for the Stanley Cup, the Raiders coming to town, the Raiders stadium construction on schedule, the Las Vegas Convention Center Authority expanding the convention center again, and marijuana being legal.

Okay, the last five items have nothing to do with housing, but to hear people talk, you would think so.

However, homebuyer mood has changed. Be it increased interest rates or Trump’s Tweets & Tariffs show, I’m told by those selling homes that buyers that were bullish with a capital B, a couple months ago. are now, not so much. My source says, “I’m the tip of the spear. What I’m experiencing now, you will read in the paper three months from now.”

Vegas is not alone in slowing down. In the comment section to Wolf Richter’s piece, IdahoPotato wrote, “It shows in stagnating home sales despite falling prices where I live.”(presumably in Idaho)

Jeff Mathews writes for curbed.com “reports suggest that in many markets that rush of offers hasn’t materialized. While home prices have yet to be affected, the apparent weakening of demand suggests that the housing market may finally be cooling down.”

“Homes are sitting unsold for weeks,” Mike Rosenberg reports for The Seattle Times. “Bidding wars are becoming less common. More sellers are even dropping their asking price to attract buyers.”

The mood on Wall Street is still bubbly. On main street, the party is winding down.