Housing Top is In

Mark Thornton makes the point in his new book “The Skyscraper Curse” that the housing market peak was signaled by a high in home-builder stocks in the summer of 2005.

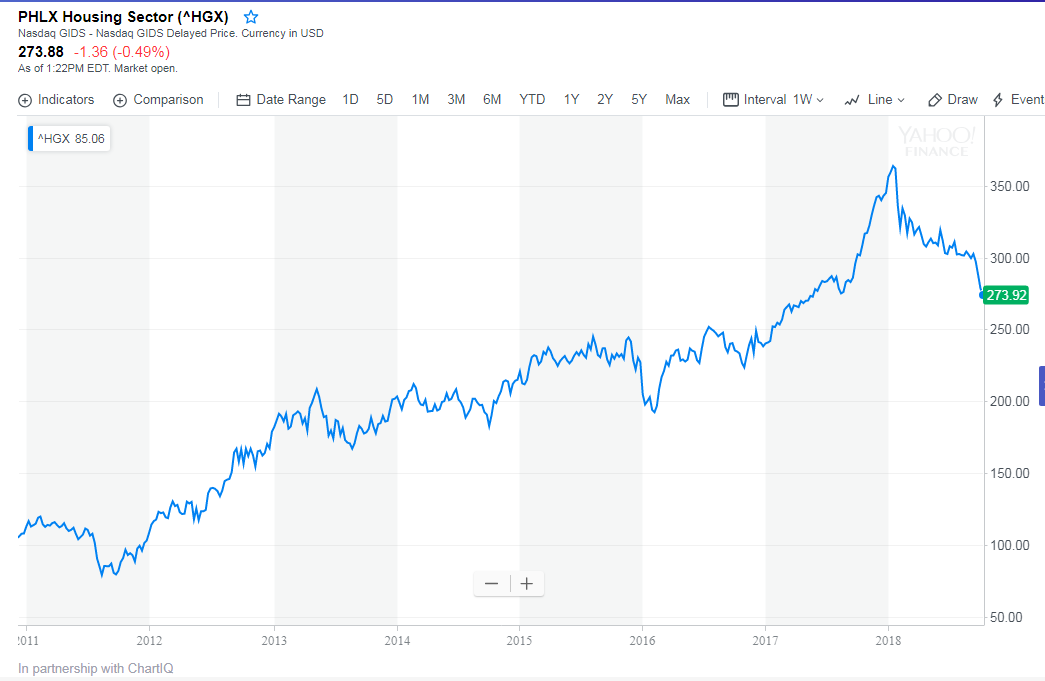

Home-builder’s index peaks in summer of 2005

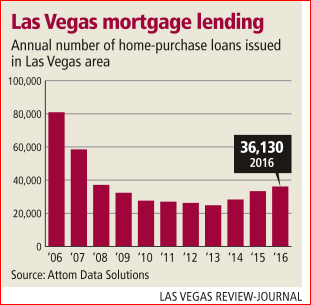

In September the median sales price hit $300,000 again in Las Vegas, the first time since 2007.

Orange Realty Group managing broker Tom Blanchard told the Las Vegas Review Journal that current median is “just another number” and doesn’t indicate that homes are too expensive or that a “doom-and-gloom bubble is coming tomorrow.”

Well, maybe not, but the Home-builder index peaked in January and that’s not a good sign.

The super tight inventory numbers have loosened and the market has slowed reports Eli Segal at LVRJ.

The interest rate which most influences mortgages is the 10 yr treasury which has increased nearly 200 basis points since it’s bottom in the summer of 2016. The latest 30-year mortgage rate per investing.com is now at 5.05% a huge jump from the 3.6% two years ago.

Home-builder’s index peaks January 2018

10-yer Treasury bottoms at 1.37% on July 4, 2016