What could go wrong? Insurance? Or, lack of it? Insurers are leaving the football market fearing Chronic Traumatic Encephalopathy (CTE) is the new asbestos.

Freddie Mac Economist: Housing Dip is a 'Mental Recession'

“We’re in a mental recession,” chief economist at Freddie Mac Sam Khater told the Journal (presumably with a straight face). “It’s a constant stream of negative headlines for a couple of months…it wears on you.”

The Value of Work

Gill’s book, “How Starbucks Saved My Life: A Son of Privilege Learns to Live Like Everyone Else” is a love letter to Starbucks’ employees and customers in between ruminations about his childhood, career, and past mistakes that left him an unemployed, broke white man in his early 60’s.

Already Bloated with Real Estate, Blackstone Bellies Up for More

Real estate fortunes rise and fall with interest rates. Low rates equal high values, high rates the opposite. If rates begin to rise as Mr. Grant’s father, Jim Grant of Grant’s Interest Rate Observer, believes, BX’s timing couldn’t be worse. Or, it may be possible, Blackstone will be fishing for distressed deals when the RE shit hits the fan.

Housing Affordability Down, Inventory Up

For those believing this is the pause that refreshes, James Stack thinks otherwise. “Housing could be heading for its worst year since the last housing crash," Stack, 67, said told Bloomberg in a phone interview. “Expect home sales to continue on a downward trend in the next 12-plus months. And there’s a significant downside risk to housing prices if a recession takes hold.”

End This “Expansion” Now Chairman Powell!

The central bank creates expansions and then murders its darlings, to borrow a phrase. Austrian economists say booms are the problem, with low interest rates breathing life into ill-conceived ventures and, once hatched, keep them from death’s door, wasting capital to the detriment of society. Recessions and depressions cleanse the economy of these malinvestments, re-aligning production with society’s collective time-preference.

Trump's Gut Feeling

The fact is, our bodies react to news and risks quicker than our brains do. Conscious thought is left in the dust when we react and especially when we take risks. Of course neoclassical economists would poo-poo the notion of our bodies reacting to threats and risks, after all, we’re all rational beings, doing what’s rational at all times. Yeah, right.

The Old Fashioned Fed Chair

Trump would like Volcker’s height, 6 foot 7 inches, as opposed to Janet Yellen, who was fired for her lack of it, at 5 foot 3 inches. However, while Trump has his eye on the stock market, Volcker always kept his on the price of gold. The ex-Fed Chair mentions the yellow metal often in “Keeping at It: The Quest for Sound Money and Good Government.”

Can Raiders Arrive Fast Enough to Save Housing Market?

Vegas was the hottest market in country two months ago, now, not so much. But home sellers are telling their realtors to check the paper for the business section headline, “Las Vegas home prices rising fastest in country, still.” Those kind of headlines have sellers listing their properties for $20,000 to $40,000 too much, realtors tell me.

Less Fed, Less Bubble

We often hear that rich are getting richer and everyone else is being left behind. However, it is only the Austrians who point to the Fed’s policies as creating this great divide in wealth and incomes.

Low CAPs, Clear Crystal Balls

Can rental rates keep climbing? Will interest rates remain low forever? Griffin Capital seems to think the answer to both questions is ’yes’.

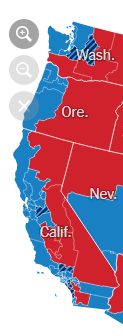

California Housing Funk Crosses Boarder to Nevada

With California being Nevada’s primary feeder market, what happens in California won't stay there, but migrate to Nevada.

Tariff Man Breaks Windows

Boehm points out that the 300 hundred jobs came to life after “American companies have paid about $690 million in tariffs to the federal government.” That works out to $2.3 million per job we know about or $300,000 per possible job.

Tweets, Bondies & Junky Monkeys

the market believed Jerome Powell sounded all lovey dovey with his comments after last week’s Fed pow wow. But, Business Insider says the “junky monkeys” didn’t hear Powell right. BI says the “bondies” are the real Powell whisperers.

The Trouble with CoCo

CoCos are similar to trust preferred debt that community banks in the U.S. stuffed balance sheets with in the early 2000s. While trust preferred was debt, the terms were so liberal, banking regulators allowed banks to count the debt as equity.

Golf Goes the way of Wrestling

Golf is game that is dying with the Greatest Generation and Baby Boomers. Golf peaked even before 2009 when Woods wrapped his SUV around a tree, escaped then wife Elin’s attempt to take a divot out of the 14-time major champion.

Trump Bump in Housing Turns into Trump Dump

Orange County “nut country” went bluer than blue on election night. Was it Trump’s fault, or maybe the Trump Bump has turned into Trump Dump in west coast housing and voters voted their falling property values.

Irrational Apartment Exuberance

Those “high rents” I referred to are now commonplace around the Las Vegas valley. I toured a project recently, located far from the strip, but with all the bells-and-whistles the Lotus has, and the owner told me he is earning $1.80/sf a month. He told me his project wasn’t for sale. We’ll see.

Dicey Bloated Government

This time, Lewis manages to find diligent, creative federal government employees (he had two million to choose from) to tell the story of Trump’s transition, or lack thereof. The thesis is, we are all at risk due to the President’s neglect. Legions of earnest federal workers were ready to smoothly hand over the monstrosity that is the federal government, and, well, no one showed up.

Can Vegas Ever Build Too Much Convention Space?

Is it possible, Las Vegas, which already has more exhibition space, by many multiples, than any other U.S. city, might build too much convention space? That more space won’t automatically turn into more heads in beds at premium prices?