“Crypto is so ruggable,” digital asset enthusiast turned prediction market devotee Nikshep Saravanan told Bloomberg. “People are tired of the game.”

Inflation Makes You Do What You Have To Do

Strip workers are auditioning to strip.

NYC Cheers Socialism, California Billionaires Run From It

Who will pay for NYC’s socialism.

Tariffs Run Whiskey River Dry

Jim Beam stops production due to tariff uncertainty.

Trump Goes Hoover

Trump evidently can’t connect the dots between the last time rates were pushed below 1% and the 9.1% annual rate of price inflation.

California Thievin'

SEIU in California seeks to tax billionaires’ net worth.

Trying to Outrun Inflation With Speculation

Paper and digital money are light as a feather. Speculations can land with a thud.

Greed Makes Bankers' Brians Turn to Mush

Tricolor failure exposes bankers’ weaknesses.

Silver: London Calling

Silver squeeze has London traders scrambling.

Las Vegas Apartment rents plunge

Cheap money spurred apartment building in Las Vegas. Now there are too many units.

Libertarian? Melei asks Uncle Sam for a Bailout

Argentina rattles its tin cup at Uncle Sam.

Gundlach on Gold

A lower dollar will lead to higher gold prices, says Jeffrey Gundlach.

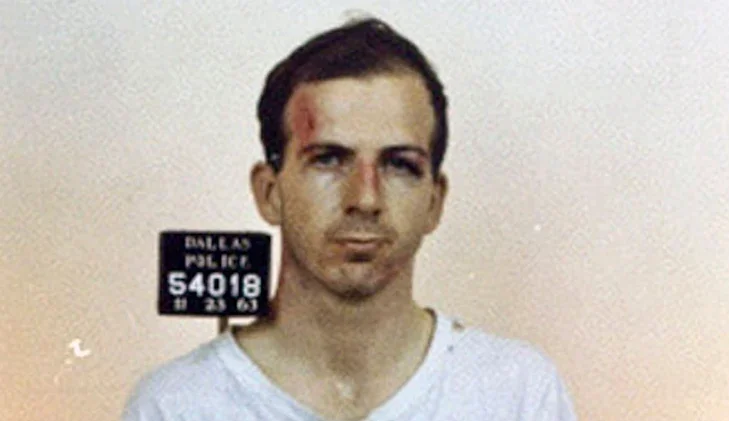

Another "Lone Nut"

Murray Rothbard questioned the lone nut thesis.

Trouble, Right Here in Sin City

Las Vegas visitation has been down for 6 months straight.

Rothbard on Billionaires

Murray always told us billionaires are kooks.

Las Vegas Chokes the Golden Goose

Benny Binion rolls over in his grave as Sin City prices itself out of the tourist market

Not Too Short, Not Too Late, Maria Would be just right for Fed Chair

Remember that when Trump took office in 2017, the very dovish Janet Yellen was Fed Chair. But he thought she was too short. So, he picked Jerome Powell who he now calls a “major loser,” a “stubborn mule” and a “numbskull.”

Silver Price Shows What Government Has Done to Our Money

Gas prices are actually lower in silver terms.

Portland's Politics and the Fall of Big Pink

Portland office building symbolizes what results with liberal policies.

COVID ZIRP Triggers ABCT in LV Industrial RE

COVID era’s low interest rates lead to malinvestment