Uncle Sam's Paper is Downgraded

While not news in the United States, the South China Morning Post reports the downgrading of U.S. government debt from A- to BBB+, “putting the debt repayment capacity of the world’s biggest economy below that of Russia and Botswana and on a par with Colombia and Peru.”

The way Beijing-based Dagong Global, a Chinese rating agency, sees it, Uncle Sam’s paper deserves, “a ‘negative outlook’ because of the US federal government’s declining capacity to repay debt, a situation worsened by tax cuts.”

No discouraging words have come from the U.S.-based ratings agencies, but Dagong “has argued that the Western system dominated by Moody’s, Standard & Poor’s and Fitch Rating is flawed and China must have its own voice in the industry,” writes Frank Tang.

It turns out the downgrade came just hours after Chinese President Xi Jinping and Donald Trump chatted on the phone.

Bloomberg reports that China’s holdings of U.S. Treasuries in November, fell to $1.18 trillion, a four month low. “The news on China’s possible plan to ease Treasury purchases fueled speculation that the country was sending a warning shot to the Trump administration that it has retaliation options in a trade dispute,” writes Shelley Hagan.

However, the Chinese may wonder about continued lending to a country close to $21 trillion in hock. Mr. Tang mentions the “fierce debate in China over whether Beijing should stop buying US government debt.

“The US government has never defaulted on its debt but Dagong’s assessment pegs it as a highly dangerous place for bond investors.”

Perhaps the Chinese have taken to heart Jim Grant’s description of U.S. Treasuries--”return-free risk.”

Grant, when questioned by Henry Bonner at Sprott Resources in 2014, reflected on the conundrum that is buying government bonds,

“Think of it” – I’m now putting words in posterity’s mouth. “Think of it, people were buying as if the supply were limited. They were buying government securities, which yielded practically nothing. They were buying bonds denominated in currencies that the central banks explicitly vowed to depreciate. Why did they do that?”

Japanese investors also exited U.S. government obligations for a second straight month in November while buying more German and French notes, reports Bloomberg.

Sid Verma and Paul Dodson write,

A widening deficit may double U.S. government bond supply this year, while tax cuts threaten to curb corporate demand for Treasuries. At the same time, Europe’s economy is booming, the euro is the best-performing currency in the Group of 10 in the past 12 months, and the region’s central bank is still buying bonds.

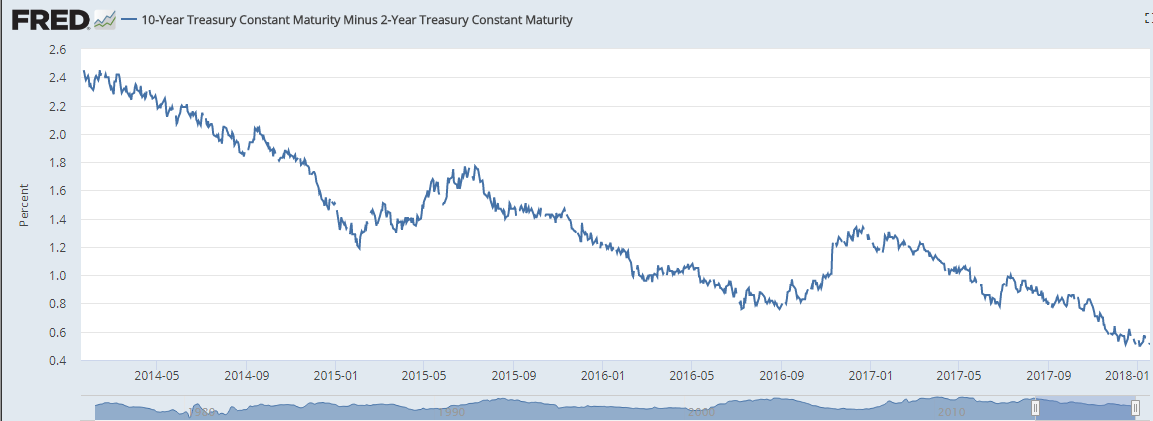

Meanwhile, the Federal Reserve has announced it has changed its policy from QE to QT and the yield curve is flattening with a vengeance. “Now there is a strong correlation historically between yield curve inversions and recessions,” Yellen said in December. “But let me emphasize the correlation is not causation.”

This time is different the outgoing Fed Chair claimed. “I think there are good reasons to think that the relationship between the slope of the yield curve and the business cycle may have changed,” Yellen said.

Downgraded debt, doubling bond supply, flattening curve: don’t worry be happy.