The Tesla Effect

The Las Vegas Sun referred to it as The Tesla Effect, “About 74,000 acres — 115 square miles — of the park east of Sparks was recently sold for about $175 million.” Lance Gilman and Roger Norman Sr. figured it would take three generations to sell out their 165 square mile industrial park opened in 1998. With only 250 acres left, they may close it out in 20 years.

“But when we met Tesla, that put us on an entirely different international platform,” Gilman told Ray Hager. “And when that platform started to grow, all of a sudden, here came Switch (and others)... and we just had these corporate groups come in here, following Tesla all of a sudden. And so we’ve entered the tech world.”

The 74,000 acres was purchased by Blockchains LLC. Gilman says of the purchaser, “They pick up a huge amount of property along the freeway (Interstate 80) for what I would call freeway-visible retail and that would include everything from hotels, truck stops and restaurants. And again, all with the blockchain technology foundation.”

So, blockchain technology can develop real estate, rent motel rooms, fuel trucks, and serve food. Who knew?

However, Tesla is the catalyst for all of this development, despite being structurally bankrupt, “which is to say it depends completely on continued capital infusions for its survival,” Montana Skeptic writes on Seeking Alpha. “Subsidies have been Tesla's lifeblood. Transferable tax credits, tax abatements, free land, cheap electricity, ZEV credits, GHG credits, CAFE credits, HOV stickers, state tax rebates, and on and on.”

The most important subsidy is the $7,500 U.S. federal tax credit for Tesla car buyers. However, that credit will be slashed in half in the fourth quarter of this year, and will be gone in 2019.

Tesla’s stock price closed over $315 a share today but famed short-seller Jim Chanos told CNBC in December, "We think the equity is worthless."

As for Tesla’s Nevada gigafactory, Mr. Skeptic writes,

The Gigafactory, far from being a strategic advantage, has chained Tesla to a type of battery cell (cylindrical) that other EV makers disfavor.

Worse, Tesla has no easy way out, as it must repay all of Panasonic's equipment investment plus a handsome ROI. As Andreas Hopf has said, on Nevada's high chaparral, Tesla is the horse and Panasonic the rider.

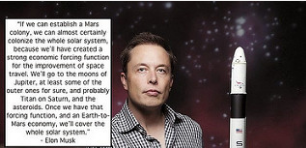

While spectators oohed and ahhed at last week’s SpaceX launch and crowed about Musk’s brilliance, his car company is burning through cash “at a clip of about $8,000 a minute (or $480,000 an hour), Bloomberg data show. At this pace, the company is on track to exhaust its current cash pile on Monday, Aug. 6.”

“Whether they can last another 10 months or a year, he needs money, and quickly,” said Kevin Tynan, senior analyst with Bloomberg Intelligence, who estimates Tesla will be required to raise at least $2 billion in fresh capital by mid-2018.

“So long as the company is burning cash, it will remain dependent on the patience and enthusiasm of public markets or the deep pockets of a white knight,” said Christian Hoffmann, a money manager at Thornburg Investment Management.

Speaking about Tesla, Bob Lutz, former vice chairman of General Motors, said "The company, folks, is going out of business. At this rate they'll never get to 2019,"

Tesla may not make it to next year, but land sellers Gilman and Norman will be long gone.