Las Vegas Housing: not exactly 2005....Yet

Home Builder’s Research has come out with its May numbers for new home sales and compared to 2011 its hot, hot, hot, up 162%. Compared to the first five months of 2005, it’s not so much, down 300%. Those were the days.

The number of closings are up nearly 28% while the median price has increased 5.6% from a year ago.

The real story is in the resale market where inventory is down to 1.7 months. “May’s resale closings (4,962) are the highest one month total that we have documented since the summer of 2005, 12 years ago,” write Dennis and Andrew Smith. They add, (For trivia purposes, the highest one-month number of existing home recorded sales was 6,682 in June, 2004.)

The Smiths contend they have never in 30 years seen resale inventory this low.

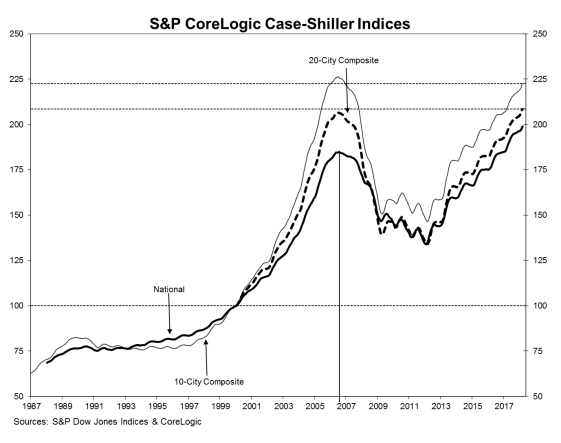

Nationwide, prices were up 17% and people are starting to talk about a bubble in house prices. The Smiths don’t think so, believing builders have learned something from the 2008 experience. “The inventory of new and resale homes remains tight. Locally, the chances of too much new home inventory that would result in price roll backs are very small. Builders understand that too much inventory (especially in in the lower end products) would result in lower profit margins, so they are pretty careful about over-building.”

The Smiths also mention, “Construction material and labor costs are still going up, so we

fully expect the median price of all new home product types to keep rising.” They don’t mention land prices, but Clark County just auctioned a handfull of parcels for prices which harken back to 2005.