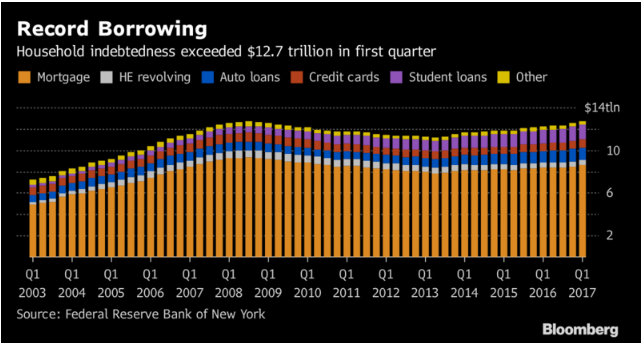

Wages aren’t going anywhere so, “For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living,” Golle writes.

All in Economics

Fed Policy: Conundrums and High Priced Junk

“Because asset prices aren’t part of official inflation measures, and because identifying an asset bubble is beyond their scope, central bankers eschew using monetary policy to respond to them.”

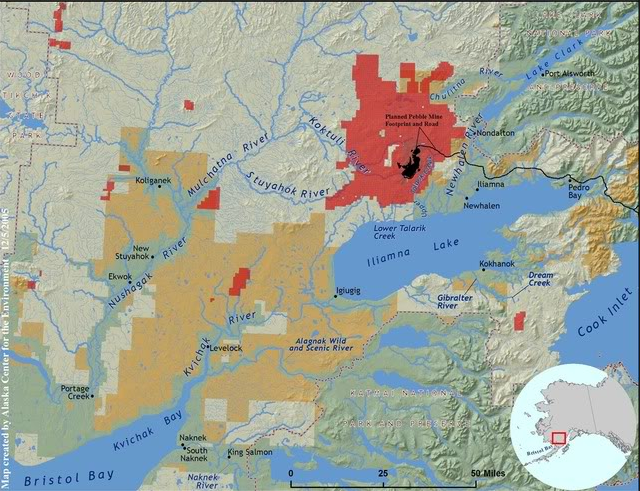

The Politics of Mining

The big three miners have cut their collective debt in half from 2014 and now the question is what do they do? “The question for investors is whether miners will continue to pay down debt—and boost dividends—or, lured by rising commodity prices, return to the big-spending ways that got them into trouble two years ago,” writes Patterson.

Dalio Says Get Yourself Some Gold

Here we are a few months later and Dalio says, batten down the hatches. “As a rule, periods of lower risk/volatility tend to lead to periods of greater risk/volatility.”

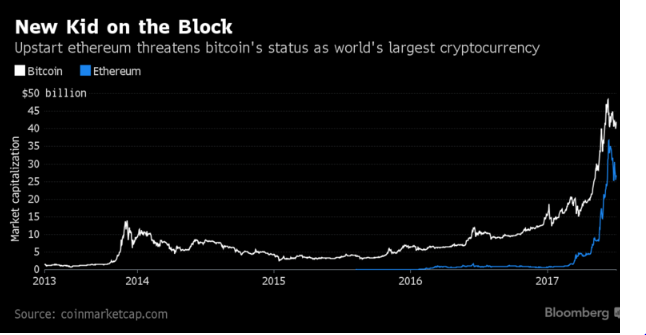

Preposterous Bubble Predictions and the Madness of Crowds

While I have friends claiming to be made wealthy in the cryptocurrency boom, it all sounds like the same old mania chatter, whether it be tulips, stocks, bonds, houses or Beanie Babies.

Currency Creation: Old and New

So while socialism has turbocharged the drain of capital and societal deterioration in Venezuela, Protocol Labs Inc. raised about $193 million for its Filecoin Network.

Monetary Policy: A Nut Here, a Crouton There

“Federal Reserve policymakers appeared increasingly wary about recent weak inflation and some called for halting interest rate hikes until it was clear the trend was transitory, according to the minutes of the U.S. central bank's last policy meeting.”

Schianto in Italiano Means Crash

The ECB gets its money to buy assets the same way the Fed, or any central bank, does--out of thin air. If government bonds are in short supply, central banks can always follow the Bank of Japan’s lead, buying ETFs in addition to corporate and sovereign bonds.

Trump and Yellen Make for a Volatile Pair

The Trump rally, as John Hussman wrote on August 7, has pushed the market to “the median price/revenue ratio of S&P 500 component stocks reached the highest level in history, advancing far beyond the levels reached at both the 2000 and 2007 market peaks.”

Elon Musk Preys on Short Memories

“It’s a well-oiled routine,” Bloomberg reports. “Musk previously tapped his cult-like followers in the equity market for capital eight times in seven years to fund Tesla’s growth. Apparently, his pitch works on debt investors, too.”

Get Lost Norma Rae

There will be no movies made of last week’s union vote at the Canton, Mississippi Nissan assembly plant. Representatives of Nissan Motor Co. and the United Auto Workers union said late Friday that 2,244 workers, or 62 percent, voted against the UAW, while only 1,307, or 38 percent, favored the union. This was the first union vote at a Mississippi plant.

Vegas Apartment Buying-Palooza

Build them and they will rent, and then Blackstone will buy.

Less Whoopie, More Shopping, Leads Developers to Overdo It

“Since 1995, the number of shopping centers in the U.S. has grown by more than 23 percent and the total gross leasable area by almost 30 percent, while the population has grown by less than 14 percent.”

Ravens Discovered to have Low Time Preferences

“ravens anticipate the nature, time, and location of a future event based on previous experiences. The ravens' behavior is not merely prospective, anticipating future states; rather, they flexibly apply future planning in behaviors not typically seen in the wild.”

New Apartments Everywhere

In 2017, the ongoing apartment building-boom in the US will set a new record: 346,000 new rental apartments in buildings with 50+ units are expected to hit the market,” three times the number of units that came on line in 2011.

Will the SEC break the Cryptocurrency Perpetual-Motion Machine?

Currency developers are working faster than Hayek ever imagined.

Neighborhood Groups Defend Their Own Walls

That’s always the argument, allow a builder to try and satisfy demand and it’s considered “a great gift.” Development entails risk. How soon people forget the video of homes in a new subdivision in Victorville, California being bulldozed.

Bitcoin Showdown

There is no Janet Yellen in the crypto-world to arbitrate this sort of monetary brouhaha. Decentralization is the silky petals of the crypto flower, but this battle between the miners and what is known as Core, a group of developers is thorny and no one knows how it will come out.

Risky Banking Turns Japanese

The problem is Japanese customers do not deposit dollars, so to buy dollar-denominated assets Japanese banks must borrow in dollars typically on a short-term basis.

Thus, the perils facing all bankers -- borrowing short to lend long.

Joined at the Hip: Trump and the DJIA

When the mood changes the President’s fortunes will change with the market’s.