Americans Back to Borrowing a Lifestyle

A home was just a home,,,and then it was an ATM, then a burden, now a home and an ATM again, reports the Wall Street Journal. “Home-equity lines of credit and cash-out mortgage refinances, two products that let consumers spend the windfall of home ownership, are back in vogue with consumers,” writes Christina Rexrode.

According to the Conference Board: “Consumer confidence increased in July following a marginal decline in June,” said Lynn Franco, Director of Economic Indicators at The Conference Board. “Consumers’ assessment of current conditions remained at a 16-year high (July 2001, 151.3) and their expectations for the short-term outlook improved somewhat after cooling last month. Overall, consumers foresee the current economic expansion continuing well into the second half of this year.”

So it makes sense, “If customers feel like their home values are stable or increasing, and if they feel like their job prospects are good—that they will have the ability to pay back a loan they take—then they will start to take out more home-equity lines,” said Mike Kinane, head of U.S. consumer-lending products at TD Bank. “That is what we are starting to see.”

Home-equity line originations rose 8% to nearly $46 billion in Q2, highest level since 2008, according to credit-reporting firm Equifax . Borrowing via cashout mortgage refinances hit $15 billion, up 6% from a year earlier, according to recent data from Freddie Mac.

So while wages may be stagnant, collateral (home) values are rising. June’s median sale price of an existing home rose to $263,800, the highest on record. A large jump of 40% from $187,900 at the start of 2014.

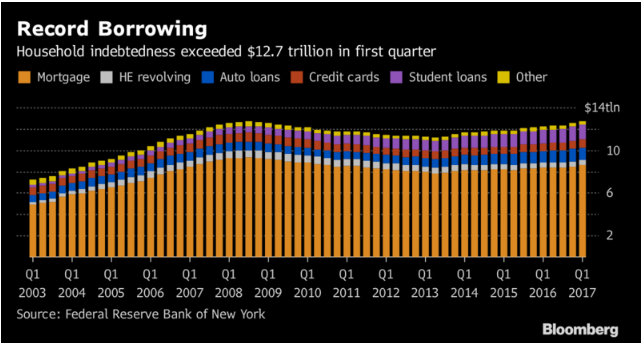

Bloomberg reports consumer debt has hit an all-time high with a total exceeding China's GDP. After quickly coming to their senses after the financial crash, consumers just a quickly fired up their credit cards.

Vince Golle writes, “Household debt outstanding -- everything from mortgages to credit cards to car loans -- reached $12.7 trillion in the first quarter, surpassing the previous peak in 2008 before the effects of the housing market collapse took its toll, Federal Reserve Bank of New York data show.”

Wages aren’t going anywhere so, “For most Americans, whose median household income, adjusted for inflation, is lower than it was at its peak in 1999, borrowing has been the answer to maintaining their standard of living,” Golle writes.

Here in Las Vegas, the median hit $246,000 in July, a $40,100 change from just two years ago, and as Dennis Smith of Home Builders Research points out “the largest part of the 2-year increase in the existing home median price was during the past 7 months, the result of the low number of competitive listings.”

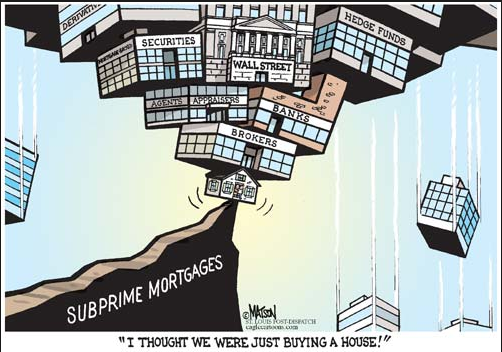

Ms. Rexrode writes, “Banks insist the increased borrowing doesn’t herald a return to housing-bubble days when consumers came to view their homes as cash registers. Banks say they are being more cautious in how they make such loans and some add they are encouraging borrowers to tackle renovations or consolidate debt—uses that are considered investments rather than luxuries.”

Yes, bankers have long memories. Not

For now, “Home-equity originations are up nicely, but continue to be outpaced by pay downs” of old lines, Bank of America Corp. finance chief Paul Donofrio told analysts in July on the firm’s second-quarter earnings call.