Meanwhile we have a modern socialist experiment imploding before our eyes. These policies have led to shortages of everything, from food to toilet paper, while the government’s printing presses have created hyperinflation.

All in Economics

Mises Killed Homo Economicus long before Thaler

In Mises's view, economics doesn't deal with homo economicus at all, but with homo agens: man "as he really is, often weak, stupid, inconsiderate, and badly instructed."

North Koreans Remember and Prepare While Trump Tweets

The hate, though, is not all manufactured. It is rooted in a fact-based narrative, one that North Korea obsessively remembers and the United States blithely forgets.

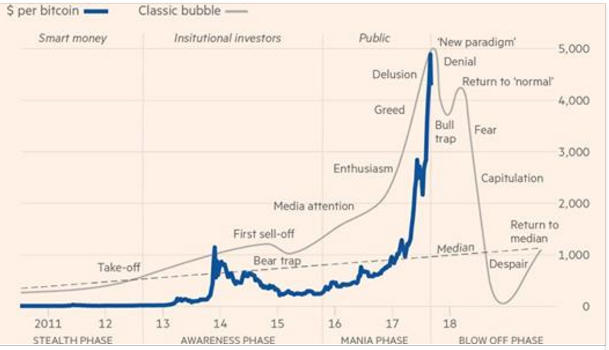

Bitcoin: Hope Springs Eternal

Of course, that’s the problem, no one can really explain bitcoin or any of the other brands of cryptos.

Musk vs. Buffett

Meanwhile, Warren Buffett is betting humans will be driving trucks for a long time to come. He bought 38.6% of Knoxville, Tenn.-based family-owned Pilot Travel Centers LLC. Pilot Flying J and plans to boost ownership to 80 percent in 2023.

Gold-backed Yuan and the Cryptos spell trouble for the Dollar

Not bitcoin backed, not ethereum backed, g-o-l-d backed. How low tech of the Chinese. For the moment, oil is priced in dollars, whether it’s Brent or West Texas Intermediate.

My Bitcoin: Lost Forever on the Blockchain

That was October 5, 2013. The following Monday bitcoin traded for $125.94. My lost crypto was no big deal then. Now, trading over $4,000 per coin. Much bigger deal. It turns out I’m just one of many to lose my coin.

Rocket Man Musk's Fantasy Land

Musk has never met a timeline he hasn’t blown, whether it's making cares, rockets or solar panels.

Politically Incorrect Architecture

“Abolish social housing, scrap prescriptive planning regulations and usher in the wholesale privatisation of our streets, squares and parks,” wrote Oliver Wainwright who was paraphrasing comments made by Patrik Schumacher shocking his architect colleagues in Berlin. Suddenly, Schumacher became “the Trump of architecture."

Housing: Distorted and Unhealthy

The housing and lending markets are among the most distorted by government intervention. By bailing out Fannie, Freddie and the big banks, not to mention crony capitalism like the Lennar/FDIC Rialto partnership, the housing and debt markets were never allowed to crash and cleanse in a properly capitalistic way.

Meredith's Prophecy: Gradually, Not All at Once

“She underestimated the glacial pace that these events take place at. She misunderstood the leeway that a local government or state is allowed based solely on past performance and presumed credibility. Most importantly she misunderstood the lengths that elected officials will go to, to avoid a problem.”

Cryptomillionaire: the Smartest Guy at the Table (for now)

My reflections on a certain real estate bubble and how it seemed similar to his acute certainty of how the future would progress made no dent in his enthusiasm.

Big Apple Cabbies and Credit Unions Suffer, while Big Money Circles

A medallion being essentially a license to drive a cab, $150,000 to $450,000 doesn’t seem like the bottom, however at the peak. 2014, a medallion went for $1.3 million. By the way, Uber was founded in 2009, but New York cab owners either didn’t get the memo, or didn't understand the implications.

Legalization Creates Violence and Product Shortages

Pot is available everywhere and only when government gets in the way does supply become a problem. The California growers association worries, as Thomas Fuller writes, “there may not be enough regulated marijuana to serve the legalized market, a highly paradoxical situation in a state that is by far the largest cannabis producer.”

Hell Hath No Fury Like a Crypto-Bubble Denier Scorned

Crypto fans might wonder what the “craft” refers to. Grant’s believes the burgeoning digital currencies have more in common with craft beers and government fiat currencies than Krugerrands, Eagles and the golden like.

Business Rebel Plays the Austrian Business Cycle (and wins)

Zell explains that entrepreneurs think differently. “It’s about how you perceive the world,” he writes. “Entrepreneurs are the ones who are always looking for opportunities to do things better. They don’t just recognize problems; they see solutions.”

What Could Go Wrong: Flight Attendants & Chimney-sweeps

The Elliott Wave folks remind us, “It’s always like this in the end. The easy way becomes the obvious way. In this case, all a person has to do is push a button and literally create money. What could go wrong?”

Meet the New Nonprime, Same as the Old Subprime

there's nothing shady or menacing about the business of subprime. On the contrary, they say, specialist lenders in this area are performing a vital service for the world's largest economy

Real Estate: the investment the common people know they want and deserve to get good and hard.

But there’s one big reason why the rich still come out ahead -- instead of stocks, the middle class puts a large share of its wealth into residential real estate. Houses tend to earn lower returns than stocks.

Vultures Wait for the Cluster of Errors

The big monied real estate players know this real estate boom is long in the tooth and are raising money to buy up the distressed pieces when the time comes.