Today his op-ed appears in the Wall Street Journal urging the Fed’s home office to lighten up on the interest rate hikes already. The President must be pleased.

All in Economics

Optimism Abounds, Dark Clouds Circle

The economy is great we’re told. Vote Republican and get more of it. “It” being--winning. However, the KBW Bank Index hit a 52-week low today. The index of small bank stocks is getting hammered. The index of European bank stocks continues to be bludgeoned by the market. And, the home builder’s index peaked in January, with big builders Lennar and DR Horton now making 52-week lows.

The Real Rialto

However, that’s not what Rialto is (or was) at all. Rialto Capital Advisors conducted day-to-day management and workout of 3.05 billion in loans the Federal Deposit Insurance Corporation (FDIC) received after it closed down banks during the financial crash.

Dimwit Minimum Wage Logic

If Bernie were paying attention, there is a minimum wage experiment going in real time in Venezuela right now. Sure, there’s some serious money printing going on there and plenty of socialist schemes to keep the shelves empty. However, the fact there’s nothing to buy hasn’t kept Venezuelan president Maduro from hiking that country’s minimum wage 24 times since 2013 when he took office.

Wage Earners Never Catch Up

U.S. Consumers and their lenders are seeing the world through Trump’s rose colored glasses. So much to buy and not enough time to save for it! Plus, the Fed’s inflation will chip away at their debts.

Musk's Tesla Trump Trick Flops

However, entrepreneurs and business people cannot lie around the market. If they make outlandish promises, the markets punish them. Ask Elon Musk, whose Tesla Trump trick recently flopped.

Tariffs to Socialism

Trade wars create winners and losers, at home and abroad. American consumers lose, as the prices are hiked while capital and labor are misallocated. This makes everyone, over time, poorer--even the tier two real estate developer.

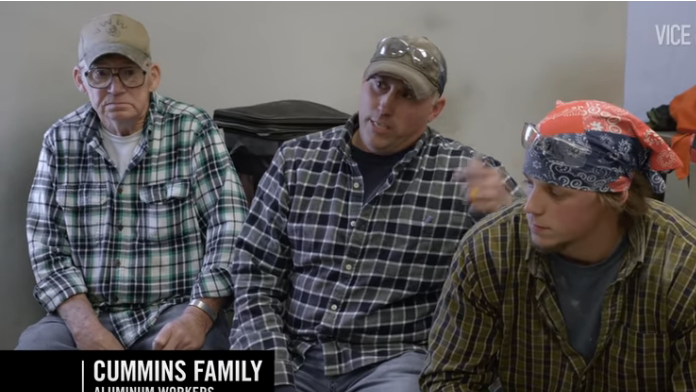

Tariff Destruction Wrapped in the Flag

Actual free trade would be a brash approach, not going full blown Smoot-Hawley. But don’t try to convince the guys on the Banner shop floor of any economics 101 mumbo-jumbo .

Trump Channels Tricky Dick

There’s plenty of blather that Trump is breaking with presidential norms by criticizing Jerome Powell’s rate hikes, but, the Donald is merely channeling Richard Nixon. When Nixon appointed Arthur Burns to be Fed Chair in October of 1969, Burns was soaking up the applause during the announcement of his appointment when Nixon broke in, saying, “You see, Dr. Burns, that is a standing vote of appreciation in advance for lower interest rates and more money.” Later, in private, Nixon told his new Fed Chair, “You see to it: no recession”

Tax Evasion: Goooooaaaallll!

Ronaldo and Messi take elaborate steps to keep money they’ve earned away from the government of Spain. Bagus and his colleagues point out the benefits of their actions. “Lacking a removal or reduction in tax levels, evasion will allow for an at least partial reinstatement of individuals’ rights of association, with resultant improvements in ethical considerations as well as economic efficiency.”

Merger Malinvestment

The primary problem is size itself. Ludwig von Mises explained that socialism doesn’t work because there was no market to determine prices and thus calculate how resources should be used. Behemoth companies are no more immune than government bureaucracies.

Tariffs: Stealing Entrepreneurs' Profits

Consumers decide what they will pay and determine value. Tariffs, the use of political force, determines where the buyer’s proceeds end up. Favored industries receive more and the entrepreneurs receive less, lowering their profits and making them less likely to take future risks in a similar political climate. As a real estate developer, the President should know better.

Trumping to Serfdom

Hayek wrote that psychopaths, er politicians, have to “weld together a closely coherent body of supporters”...appealing “to a common human weakness. It seems to be easier for people to agree on a negative programme – on the hatred of an enemy, on the envy of the better off – than on any positive task.”

Debt Conceit

The markets believe Mr. Powell is cooking his porridge just right--not too hot, not too cold--and, most importantly, not blow up the stove, or the whole house.

The Hits Keep Coming for Deutsche Bank

At the end of last year, Deutsche’s U.S. operations had $7.3 billion of equity supporting $148 billion of assets, or 20 to 1 leverage. Then there is the derivatives exposure of $50 trillion (with a T).

Problem Canary in Bank Coal Mine?

The number of problem banks was only 92 at quarter end, the assets of problem banks more than tripled to more than $60 billion. That means two or three banks of considerable size are now considered “problem” banks. The regulator doesn’t say which banks, so lines don’t form outside.

Trouble in Euroland

Little old Italy, you might ask. While small in land mass, the Italian government has borrowed mightily: the fourth largest bond market in the world, behind, China, Japan and you know who.

Eisman of 'Big Short' Fame Doesn't Believe Cryptocurrencies Have Value

Eisman joins Warren Buffet in dissing cryptos in recent days. The Oracle of Omaha had harsher words for digital currencies, calling them, “probably rat poison squared’ and predicted cryptocurrencies “almost certainly...will come to a bad ending.”

Demand for Gold Coins Crashes

When the public was worried the end of the modern financial world was near, they were stocking up on gold, and presumably canned goods. However, the last few years has proven the coast is clear: paper and computer generated “assets” will do just fine.

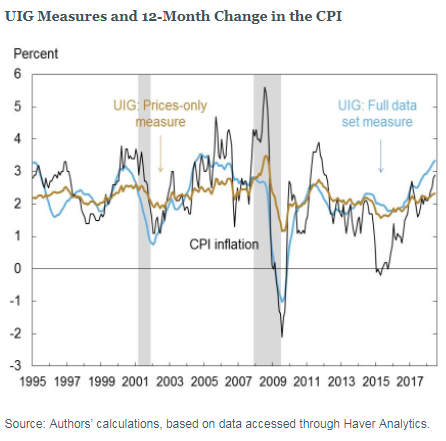

Stagflation to take down Keynesians Again

Other than a scattered Austrian here and there, Bernanke and his successor Janet Yellen went about their business unquestioned. Quantitative Easing (QE) was the Keynesian magic wand that kept the ATMs operating on time.