Mom and Pop Plunge into Bitcoin

Bubbles don’t generally pop when lots of people are saying “it’s a bubble and it’s gonna pop.” Plus, if it weren’t for the internet, I’d never hear the word bitcoin. There is no discussion of bitcoin in my day-to-day life, making me wonder if amatuer plungers are playing in this market at all.

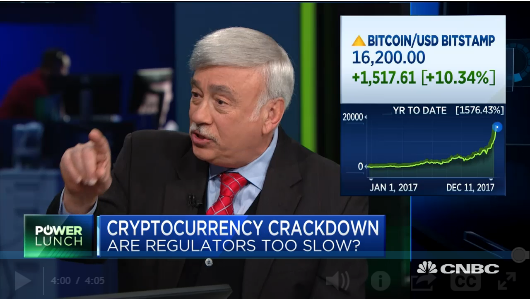

But today on CNBC, Joseph Borg said, "We've seen mortgages being taken out to buy bitcoin. … People do credit cards, equity lines." Borg is the president of the North American Securities Administrators Association, a voluntary organization devoted to investor protection. He is also director of the Alabama Securities Commission.

Co-Host Michelle Caruso-Cabrera (MCC) replied, “Holy smokes.”

Borg said, "This is not something a guy who's making $100,000 a year, who's got a mortgage and two kids in college ought to be invested in," calling Bitcoin, “tulipmania without the tulips.”

He told the Power Lunch crew, "You're on this mania curve. At some point in time there's got to be a leveling off. Cryptocurrency is here to stay. Blockchain is here to stay. Whether it is bitcoin or not, I don't know,"

The regulator went on to regale the hosts with a story about someone emailing him, guaranteeing a $13,000 one-day profit in Bitcoin.

Hyman Minsky and Charles Kindleberger outlined the steps in a boom and bust, which I mention in “Early Speculative Bubbles.”

Near the top of the market is, “When the neophytes, attracted by the prospect of large capital gains for a small outlay, become numerous in the market, the activity assumes a separate abnormal momentum of its own. Insiders recognize the danger signals and move out of securities into money.”

I’m not sure who the insiders in the Bitcoin world might be. True believers in all things crypto do not have danger on their mind. They believe they own the new coin of the realm. In fact, all it took is the word crypto to send a particular stock soaring. Grant’s Almost Daily reports,

Shares in over-the-counter name The Crypto Company, which listed in May and traded below $20 as recently as Dec. 1, have gone on a parabolic run in the last ten days, currently fetching $642 a share. That gives the Malibu, Calif.-based business a market capitalization of $12.6 billion.

Valuing the Crypto Co. is somewhat difficult, as the only public filing on Edgar [the SEC website] is its securities offering document, in which it ticks the box “decline to disclose” under revenue range. The company’s website does note that it’s in the business of providing “institutions and individuals direct exposure to the growth of global blockchain developments.”

Steven Hochberg writes for the Elliott Wave Financial Forecast,

As for bitcoin, last night’s (Sunday) initial trading in bitcoin futures on the Cboe quickly carried prices through several exchange-based trading halts, when prices rose above 10 percent and then above 20 percent from their opening at $15,000. The January contract made a high at $18,850 in overnight trading. Prices pulled back from there and then rallied this afternoon. As of publication, they were $18,660. The futures contract is the definition of speculation as it is cash-settled, meaning that at the end of the third week in January, you can’t receive any bitcoins, only the dollar equivalent. If you want to own bitcoin, you actually have to buy bitcoin. Which means that you have to be able to sell it at some point in the future, which may or may not be possible, or at least easy.

Mom and Pop are not deterred. The Wall Street Journal reports,

A trading vehicle that holds bitcoin was the most traded security by Fidelity Investments customers in recent days. The $1.7 billion Bitcoin Investment Trust, which trades intraday like a stock but has a limited number of shares, had 2,407 buy and sell orders on the Fidelity platform Friday, making it the most traded security by number of orders, according to the company’s website. That included 1307 buy orders and 1100 sell orders.

On Friday, the Bitcoin Investment Trust, traded over the counter through the OTCQX electronic market, had volume of $280.7 million, making it the most active security in that market, according to the OTC website.

This all seems like the top of a market, not the beginning.