Who's driving Bitcoin: Mrs. Watanabe, Millennials, & Teenage Whiz Kid.

Who is pushing the price of Bitcoin higher? “It’s not drug dealers and tax cheats, it’s Mrs. Watanabe,” writes Julie Verhage, referring to the Japanese retail investor avatar.

Reports Bloomberg. “The bank [Deutsche Bank]pointed to a Nikkei report saying that about 40 percent of cryptocurrency trading was yen-denominated in the October and November and is likely rising since China started to shut down digital-currency exchanges.”

But Tom Lee told the CNBC crew that millennials are driving Bitcoin, like baby-boomers drove the stock market.

"I think what viewers have to appreciate is, this is a millennial story," Fundstrat's Lee said Tuesday on CNBC's "Squawk Box." "The average millennial is 25 today. The boomers were 25 in 1982, so what did the boomers drive from 1982 to the peak population of the boomers, which was '99? The S&P 500."

An October survey found 27 percent of millennials would prefer to invest in $1,000 of bitcoin versus the same amount of stocks.

Millennials are hoping Ronnie Moas is right. He said, "The end-game on bitcoin is that it will hit $300,000 to $400,000 in my opinion, and it will be the most valuable currency in the world," on CNBC's "The Rundown."

"I don't know how much gold there is in the ground, but I know how much bitcoin there is, and in two years there will be 300 million people in the world trying to get their hands on a few million bitcoin. This mind-boggling supply and demand imbalance is what is going to drive the price higher," Moas said.

Bill Fleckenstein sees it differently,

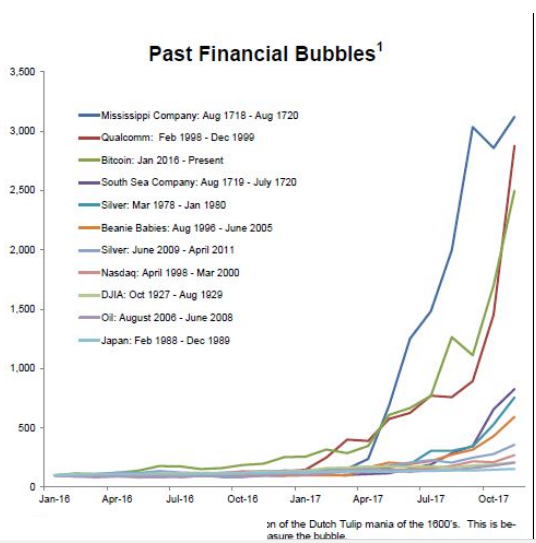

Meanwhile, the crypto craze is in full bloom, with wild speculation taking place in the roughly 1,350 of other non-Bitcoin "coins." It would not surprise me to see this madness carry on through the holidays as folks use their idle time to make money in the easiest way possible (so they think), i.e., owning cryptos. It will be interesting to see how that market (as well as many others) trades in early January.

Perhaps it’s high school kids like Erik Finman who, with 403 Bitcoins, is a teenage millionaire who won a bet with his parents and doesn’t have to go to college. Finman told CNBC’s Kelly Evans that Bitcoin is “the future of currency and the future of the financial system...that’s what it’s backed by.” He is heavily diversified in other cryptocurrencies, he said, as as well as assets outside cryptocurrencies.

Responding to a question about every government banning Bitcoin, Finman mentioned Liberty Dollars, the scheme of Bernard von NotHaus, and compared Bitcoin to von NotHaus’s coins, saying “the technology allows Bitcoin to trade even if every government bans it.”

Finman dropped out of high school and never got his GED. He doesn’t see any value in education as its purpose would be to later on get a job and he already knows how to run a business. “Instead of writing essays for English class, I had to write emails to important people,” he says. “I would recommend the internet, which is all free. You can learn a million times more off YouTube and Wikipedia.”

How high does Finman think the price of Bitcoin will go? “Personally I think bitcoin is going to be worth a couple hundred thousand to a million dollars a coin.”

Bitcoin is down today at $17,388. “A detailed look at the individual markets suggests that the money could be flowing out of bitcoin and into rival cryptocurrencies,” Coindesk reports.