Millennials See White Picket Fences

Building entry-level priced homes is back in again, reports the Wall Street Journal. A year ago The Atlantic reported that young people weren’t buying homes due to being either super mobile or stuck.

The supermobile are, “ambitious, devoted to their professional lives, and comfortable with a life path that has them getting married in their late twenties-to-mid-thirties.”

The stuck are, “Millennials who grew up in poor neighborhoods are less likely to move, less likely to go to college, and even if they go to college, they are less likely to leave their zip code.”

But homebuilders see it differently. “Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,” write Laura Kusisto and Chris Kirkham for the WSJ.

Derek Thompson sounded a sour note, writing, “The decline in Millennial homeownership today is a single simple statistic masking a complex distribution of motivations. Rich, urban, college-educated, and supermobile Millennials have elected to trade their 30s for their 20s when it comes to buying a home. Meanwhile, poorer, less-educated, and stuck minorities have often traded homes and apartments for their childhood bedroom. Only one of these trends is worth cheering.”

But builders are reading the tea leaves and seeing opportunity. “There’s an increasing confidence level in that part of the market,” said Gregg Nelson, co-founder of California home builder Trumark Cos. “The recovery is finally starting to take hold in a broader way.”

“They’re crawling out of their parents’ basements, they’re forming households and they’re looking to buy,” said Doug Bauer, chief executive of Tri Pointe Group Inc., which operates in eight states.

It was conventional wisdom that millennials wouldn’t buy houses or cars and spend their money servicing their student loans and paying for “experiences.” But, maybe they want the American dream of a white picket fence and the ball and chain of a mortgage just like previous generations.

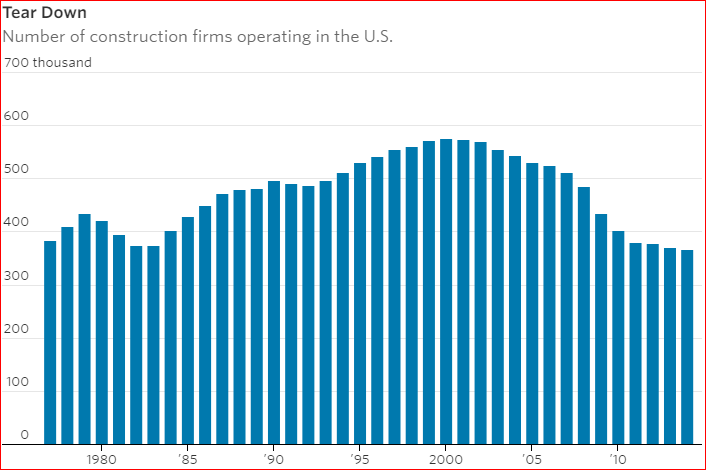

“The return of first-time buyers allays fears that millennials would eschew homeownership and provides a long-awaited infusion of new demand to the market. These new buyers could also be a boon to the overall economy by driving builders to build more homes. But demand is ramping up at a time when supply is already tight and price growth is significantly outstripping wage gains,” explain Kusisto and Kirkham.

Homebuilders know millennials are like anyone else, they want their cake and eat it too. Tri Pointe’s new-home design with separate downstairs bedroom-and-bathroom suite could be rented out to a roommate is specifically targeted to millennial buyers. Buy that first home and rent out a part to help pay the mortgage.

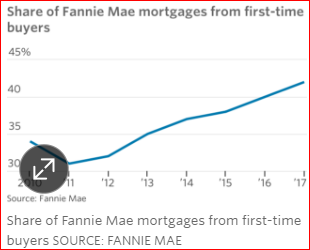

The statistics say the millennials are coming “Some 42% of the mortgages acquired by Fannie Mae so far this year were to first-time buyers, up from 31% at the recent low in 2011 and 38% in 2015.”