To refresh our memories, Jurow says, “2006 was just insane. 320 billion dollars taken out in cash just in that year, and boy, the debt helped the economy continue, even though things were showing signs of real problems.”

All tagged housing

Freddie Mac Economist: Housing Dip is a 'Mental Recession'

“We’re in a mental recession,” chief economist at Freddie Mac Sam Khater told the Journal (presumably with a straight face). “It’s a constant stream of negative headlines for a couple of months…it wears on you.”

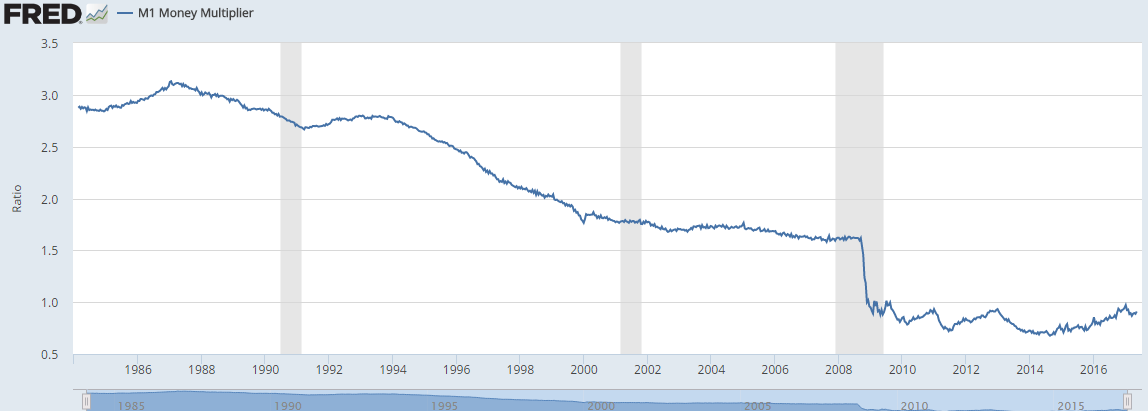

Credit now Repaired, Money will Multiply

An increase in lending might just kick start the money multiplier and then some honest-to-goodness, noticeable, government-can’t-deny-it price inflation might be just around the corner.

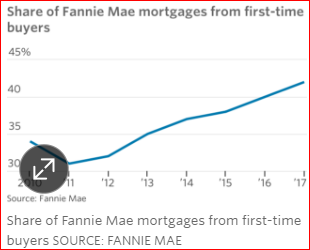

Millennials, You Don't Need No Stinking Down Payment.

The American dream of paying on a big fat, paycheck sucking and mobility stifling mortgage is just waiting for you. Take the plunge. Make America great.

Millennials See White Picket Fences

“Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,”

Las Vegas Housing

The home market is still highly sensitive to interest rates. Employment/building permits is an interesting ratio that for the moment looks good, but could flip in a hurry.