Credit now Repaired, Money will Multiply

Lee Adler, writing for David Stockman’s Contra Corner about the resale housing market, “The Closings to Contracts ratio is a good indicator of market psychology. Over the previous 6 months, the market had gotten frothier and the percentage of sales making it to closing steadily rose. That meant that lenders were loosening underwriting standards and appraisers were pushing values higher under pressure from lenders. That is what typically happens in the late stages of a localized or national housing bubble.”

Adler explains, “When only 85-90% of sales close, that's an indication of a market with conservative credit standards.” He believes that lenders are beginning to panic trying to beat “rising house prices and the next mortgage rate increase.”

Meanwhile, the Wall Street Journal reports,” The average credit score nationwide hit 700 in April, up one point from last fall, according to new data from Fair Isaac Corp. That is the highest since at least 2005.” As Pareto might have predicted, 20% of the country have credit scores below 600, making them less creditworthy.

The WSJ subtitle provides some insight into the improved scores “More than six million U.S. adults will have personal bankruptcies disappear over the next five years, according to a recent report.”

“Higher scores lead to more available credit,” said Cris deRitis, senior director in the economics group at Moody’s Analytics. “We’d see more activity in terms of loan approvals and credit-card approvals, more spending and that would have a ripple effect across the economy, increasing aggregate demand for goods and services.”

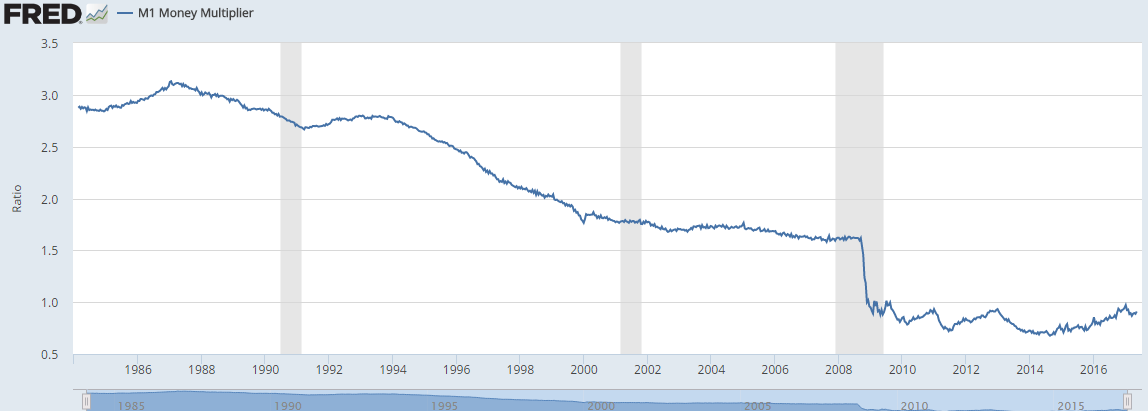

An increase in lending might just kick start the money multiplier and then some honest-to-goodness, noticeable, government-can’t-deny-it price inflation might be just around the corner.