Flip It, Flip It Good

Nothing says boom like flip. House flipping that is. The indispensable Eli Segall reports in today’s Las Vegas Review Journal that first quarter flipping was muy profitable in Sin City.

Las Vegas house flippers booked an average gross profit of $51,500 per deal in the first quarter. That’s up 29 percent from the same period last year and the biggest haul since at least early 2005, according to Attom Data Solutions, which defines a flip as selling a home within a year of buying it.

Ten percent of all sales in Q1 were flips, making Vegas the fifth flipping hottest market in the U.S. It turns out Memphis, Tennessee topped the flipping list with 15.1 percent of sales being flips.

The flippers average gross profit in the three months ending March 31 was 34.3 percent, up from an average 27.6 percent margin a year earlier, according to ATTOM Data Solutions, a company that keeps close track of these flipping statistics.

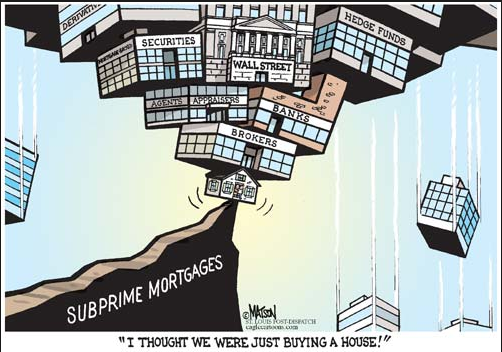

Of course, making 34 plus percent is pretty flipping sweet and no doubt, more and more people will forget all about 2008 and try their flipping hand at this.

However, flippers flip when lenders lend. At the end of last year the Wall Street Journal reported, “In recent months, big banks, including Wells Fargo & Co., Goldman Sachs Group Inc. and J.P. Morgan Chase & Co. have started extending credit lines to companies that specialize in lending to home flippers.”

Kirsten Grind and Peter Rudegeair wrote for the WSJ,

The number of investors who flipped a house in the first nine months of 2016 reached the highest level since 2007. About a third of the deals in the third quarter were financed with debt, a percentage not seen in eight years.

While waiting to do a CT scan the other day, I noticed the half-full waiting room was glued to HGTV’s “Property Brothers.” Three people who sat near me, even said, when they came in,” Oh good, the Property Brothers are on.”

“House-flipping television shows and training ‘schools’ for new investors are proliferating,” Grind and Rudegeair wrote. “One ‘super-intense, hardcore’ house-flipping boot camp in Bourne, Mass., promised to teach students about real-estate investing in three days to make ‘REALLY MASSIVE PROFITS,’ according to marketing literature.”

Mr. Segall has high hopes for long memories.

Last decade, flippers helped inflate property values until they burst. This time around, let’s hope the tight housing market doesn’t grow so much — and so fast — that our expanding waistline breaks its belt again.

“Finance companies say their loans to home flippers are prudent,” reports the WSJ. “There’s plenty of money to be made,” says David Franco, who lives just outside of Los Angeles and has more than $200,000 in profit on houses he refurbished and resold.

It all sounds familiar.