Help Wanted: Lenders with No Experience (or Short Memories) to Make Risky Mortgages

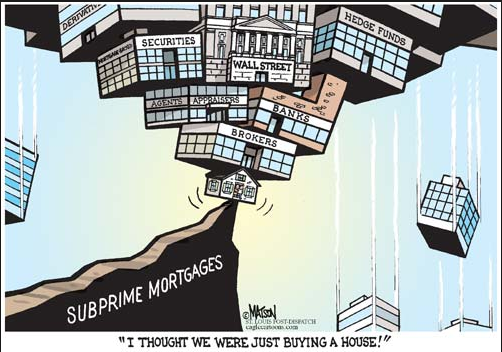

They’re back. Subprime mortgages. And loan brokers are needed to start making them. Kirsten Grind, who, by the way, wrote a wonderful book about Washington Mutual (WaMu) entitled “The Lost Bank,” writes for the Wall Street Journal, “Brokers willing to learn the lost art of making risky mortgages are in demand again.”

Home values are up, flipping is back in vogue, and more than a little subprime sauce is needed to keep the party cooking. Putting a face on the subprime broker demand Ms. Grind features a former Calvin Klein salesman who admits he didn’t know much about housing finance. “‘I knew a mortgage was a loan for a house,’ said Mr. Boyd, who was recruited by his boss, Jon Maddux, after selling him a Calvin Klein suit at a local outdoor mall. ‘I came in just a blank slate.’”

Mr. Maddux now owns Drop Mortgage. But at the depths of the crash his business was “YouWalkAway.com between 2008 and 2012. The site charged homeowners on the brink of foreclosure $995 to learn how to leave their debt behind.”

Of course there’s a good market for loans to folks who don’t fit in the Dodd-Frank box and lenders can earn 6% to 10% from borrowers sporting credit scores of 660 and below. But fresh-faced originators can’t figure out how to make the loans.

“A lot of (the brokers) are timid and scared and don’t know where to start with the nonprime type loans,” Steve Arnold, who is based in West Palm Beach, Fla. told Ms. Grind. Mortgage lenders have succumbed to Stockholm Syndrome and can’t figure out how to make anything but a drop-dead lead pipe cinch conforming mortgage.

Krista Donecker, an account executive at Irving, Texas-based Caliber Home Loans Inc. tells Grind, “It’s been a hard battle” against the stigma of subprime lending. She gives presentations on originating subprime loans and remembers a broker asking her, “Are you sure this isn’t illegal?”

Ironically, subprime is making a comeback while European banks fight “the same kind of heavy-handed rules for banks’ mortgage holdings that have been adopted by their American counterparts,” reports Bloomberg.

“‘By and large, Germans pay their debts’ and are nowhere near as risky as American lenders and home-buyers have been in the past,” says Deutsche Bank AG chief John Cryan. Ouch.

This is all about measures that are “part of the completion of Basel III, effectively [to] increase the capital backing mortgages held on banks’ balance sheets to ensure that lenders can weather another economic downturn,” writes Matt Scully for Bloomberg.

In the conventional loan market, “Interest rates fell last week to the lowest level since November, and the seasonally adjusted mortgage volume jumped accordingly, up 7.1 percent, according to the Mortgage Bankers Association,” reports Diana Olick for CNBC.

"Purchase application volume increased to its highest level since May 2010. Refinance activity bumped up as well in response to moderating rates, but remained generally subdued," said Joel Kan, an MBA economist.