Toilet paper may be in short supply, but the Federal Reserve is determined to make sure dollars are not.

All tagged Federal Reserve

Banks’ Unrealized Losses soon to be Realized

The folks at GNS Economics, in their “Q-Review 1/2019” report, contend, contrary to the president, “the global economic recovery since 2009 has not been real. It has been achieved with massive debt and monetary stimulus, which has created an economy where normal rules of the market economy do not apply.”

Karshkari Tells Powell to Stop Raising Rates and Hopes Trump Takes Notice

Today his op-ed appears in the Wall Street Journal urging the Fed’s home office to lighten up on the interest rate hikes already. The President must be pleased.

Debt Conceit

The markets believe Mr. Powell is cooking his porridge just right--not too hot, not too cold--and, most importantly, not blow up the stove, or the whole house.

Stagflation Appears while the Fed Wonders "Why is Inflation so Low?"

Yes, the economy is putty in the skilled hands toiling at the Eccles Building. Meanwhile, the St. Louis outpost of America’s central bank just published in its latest monthly report “Why is Inflation so Low?”

Fed Policy: Conundrums and High Priced Junk

“Because asset prices aren’t part of official inflation measures, and because identifying an asset bubble is beyond their scope, central bankers eschew using monetary policy to respond to them.”

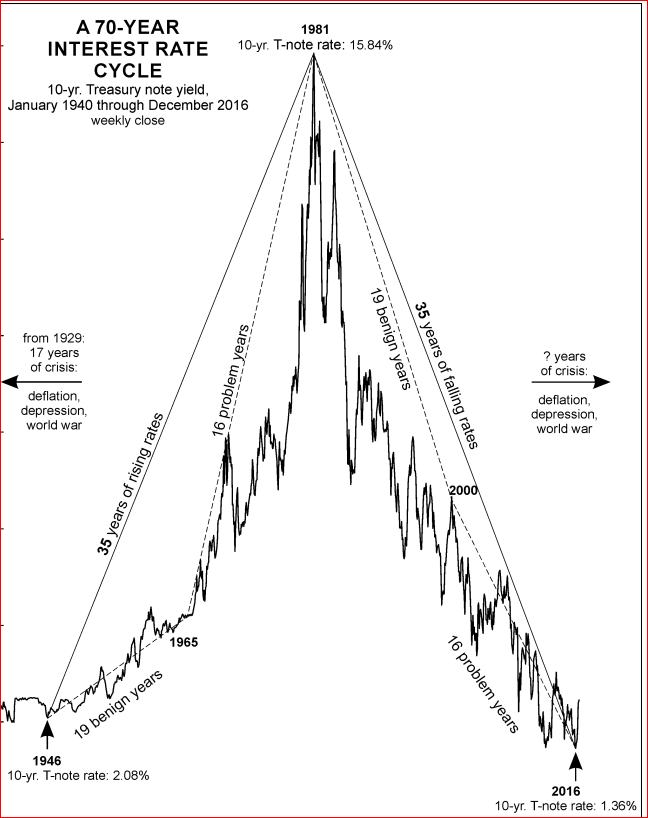

Old Fed or New Fed, Rates are Headed Up

does the Fed really set interest rates or follow the market?

Keynesians at the central bank think people are just so many particles to be plugged into their models to determine what to set the fed funds rate to, or how much Q to stir into its QE. But when the researchers plugged numbers into MV=PQ, they admitted, “(I)nflation in the U.S. should have been about 31 percent per year between 2008 and 2013, when the money supply grew at an average pace of 33 percent per year and output grew at an average pace just below 2 percent.”

Rickards emphasizes that economic order emerges spontaneously from economic complexity instead of being imposed by central bankers and their policies. So what we have now with central bank central planning is disorder and continuous malinvestment.

The Independent Institute’s Boom and Bust Banking: The Causes and Cures of the Great Recession features multiple authors but puts the blame for the crisis with one institution–the Federal Reserve.