Silicone Hookers and Phony Interest Rates

While the world stresses about #metoo, Trump’s tweets, and other cultural nonsense, the latest Grant’s Interest Rate Observer is blunt about “the most consequential prices in capitalism--interest rates…” Rates are “stuck under the bureaucratic thumb.” There is no mystery or debate, “It’s as plain as meatloaf that something is wrong with credit.”

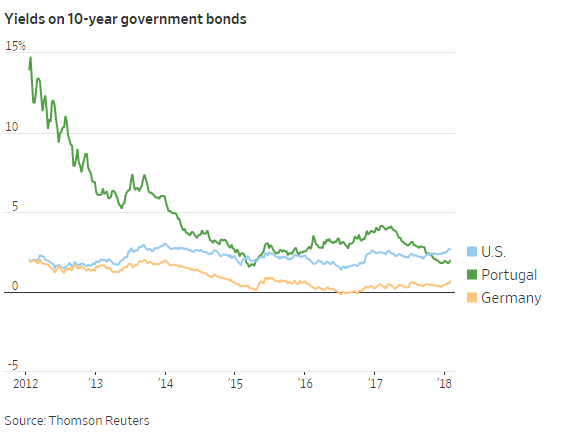

Mario Draghi has pushed rates in Europe into the never-never land of zero and below, attempting prove Murray Rothbard wrong when he wrote in Man, Economy and State, “the interest rate can never disappear.” Financial basket case Greece, has 10-year bonds yielding 3.69%, 69 basis points is all Germany is paying and France’s bonds are yielding 96 basis points. These rates are as fabricated and detached from reality as the silicon sex doll brothels now opening throughout Europe.

“Since it was reported in the summer of 2017 that sex doll Fanny was attracting more customers than real-life prostitutes at the Kontakthof brothel in the Austrian capital, Vienna, the sex doll craze has taken Europe by storm,” writes Gemma Mullin.

Grant’s highlights the work of Claudio Borio, who says persistent low rates are adverse to productivity, in humans that is. No doubt, the silicon dolls will be infinitely more productive, if not outwardly ambitious.

Low rates lead to malinvestments as illustrated aptly by Matt Wirz’s excellent reporting for the Wall Street Journal. Wirz leads his piece with,

Last fall, a hydroelectric dam in Tajikistan, the government of Portugal and a cruise-ship operator all issued debt at unusually low interest rates. The seemingly unconnected deals are part of a proliferation of aggressive bond sales influenced by a decade of loose monetary policy and a demographic shift in global investing.

Investors held $1.5 trillion in U.S. Bond mutual funds 10 years ago, now it’s $4.6 trillion.

Portugal required a financial bailout in 2011. However, this past November all that was forgotten as the country with junk rated debt borrowed at its lowest rate ever, 1.94% for 10-year paper. That’s lower than what Uncle Sam is paying on its higher-rated bonds.

Sounding like a member of the Austrian school, Borio says monetary policy boosts “credit, asset prices and risk-taking.” Grant’s reminds us that Ben Bernanke, himself, wrote that easy money was needed to “boost consumer wealth and help increase confidence.”

And you thought the current ebullience was ginned up by Donald J. Trump?

Borio believes “ultra-low rates delay balance sheet adjustment and sustain the lives of corporate living dead.” Wirz provides examples from corruption-plagued Tajikistan, where bond investors funded $500 million to kick-start construction of a hydroelectric dam project first started under the Soviet Union, and “the American Dream Mall in East Rutherford, N.J., also got a jump-start from bond markets in 2017. The project, previously known as Xanadu, broke ground in 2003 but ran out of money to finish construction. The mall’s current owner—its third—is betting that it can buck the trend of retail extinction spreading across the country.”

Hope springs eternal and low interest rates turn hope into a strategy. But, not a good one.

Rothbard explained, “The interest rate regulates the temporal order of choice of projects in accordance with their urgency. A lower rate of interest on the market is a signal that more projects can be undertaken profitably. Increased saving on the free market leads to a stable equilibrium of production at a lower rate of interest.”

Clearly, investors and business men and women have been fooled by Draghi, Yellen, and soon enough, Powell. In the end, it will be as Rothbard saw it in America’s Great Depression,

inflation is not the only unfortunate consequence of governmental expansion of the supply of money and credit. For this expansion distorts the structure of investment and production, causing excessive investment in unsound projects in the capital goods industries. This distortion is reflected in the well-known fact that, in every boom period, capital goods prices rise further than the prices of consumer goods. The recession periods of the business cycle then become inevitable, for the recession is the necessary corrective process by which the market liquidates the unsound investments of the boom and redirects resources from the capital goods to the consumer goods industries. The longer the inflationary distortions continue, the more severe the recession-adjustment must become.

The reader is urged to review the last sentence carefully a send time. This latest distortion is very long in the tooth.