The US economy has become hyper financialized, says Pal. If the S&P 500 goes down, employees are laid off. And, we all know that one of the Fed’s mandates is maximizing employment. “It's like nothing will last long because the Fed will not allow it to.”

All tagged Murray Rothbard

Musical Chairs Markets

Since when does forecasting a couple rate bumps two years from now be considered hawkish to the point of making the dollar pop and gold flop?

The Weirdest, Most Distorted Economy Ever

The US economy is split into “the weirdest economy ever” when writing about The Trucking Boom and Online sales, and “the most distorted economy ever” when addressing the record low junk bond yields.

Infinite Cash, Scarce Toilet Paper

Toilet paper may be in short supply, but the Federal Reserve is determined to make sure dollars are not.

Coronavirus Deniers

Pal does not blame the president. He’s in the finance and investments business. For him, this is all about coming out on the other side, healthy and financially solvent. He has no political axe to grind.

The Fed Creates the Need for Side Hustles

Quart’s Sunday Times piece is entitled “The Con of the Side Hustle.” People taking on multiple jobs refer to them as “side hustles.” Which is kind of cute. Uber is recruiting online, not with the tagline “do you have to have a second job to pay your bills” but rather something cool, like, “Get your side hustle on.”

End This “Expansion” Now Chairman Powell!

The central bank creates expansions and then murders its darlings, to borrow a phrase. Austrian economists say booms are the problem, with low interest rates breathing life into ill-conceived ventures and, once hatched, keep them from death’s door, wasting capital to the detriment of society. Recessions and depressions cleanse the economy of these malinvestments, re-aligning production with society’s collective time-preference.

Less Fed, Less Bubble

We often hear that rich are getting richer and everyone else is being left behind. However, it is only the Austrians who point to the Fed’s policies as creating this great divide in wealth and incomes.

Dimwit Minimum Wage Logic

If Bernie were paying attention, there is a minimum wage experiment going in real time in Venezuela right now. Sure, there’s some serious money printing going on there and plenty of socialist schemes to keep the shelves empty. However, the fact there’s nothing to buy hasn’t kept Venezuelan president Maduro from hiking that country’s minimum wage 24 times since 2013 when he took office.

Tariffs to Socialism

Trade wars create winners and losers, at home and abroad. American consumers lose, as the prices are hiked while capital and labor are misallocated. This makes everyone, over time, poorer--even the tier two real estate developer.

Tariff Destruction Wrapped in the Flag

Actual free trade would be a brash approach, not going full blown Smoot-Hawley. But don’t try to convince the guys on the Banner shop floor of any economics 101 mumbo-jumbo .

Stagflation to take down Keynesians Again

Other than a scattered Austrian here and there, Bernanke and his successor Janet Yellen went about their business unquestioned. Quantitative Easing (QE) was the Keynesian magic wand that kept the ATMs operating on time.

Silicone Hookers and Phony Interest Rates

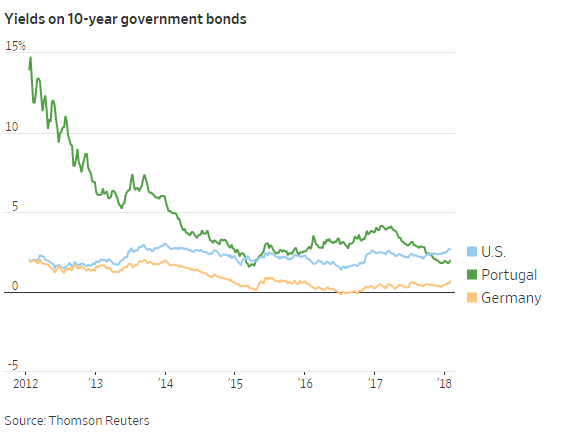

Financial basket case Greece, has 10-year bonds yielding 3.69%, 69 basis points is all Germany is paying and France’s bonds are yielding 96 basis points. These rates are as fabricated and detached from reality as the silicone sex doll brothels now opening throughout Europe.

Tiny CAP rates, Massive Malinvestment

Grant wonders aloud during the podcast whether these central bank induced low rates are “perpetuating obsolete business models.”

Politically Incorrect Architecture

“Abolish social housing, scrap prescriptive planning regulations and usher in the wholesale privatisation of our streets, squares and parks,” wrote Oliver Wainwright who was paraphrasing comments made by Patrik Schumacher shocking his architect colleagues in Berlin. Suddenly, Schumacher became “the Trump of architecture."

Vultures Wait for the Cluster of Errors

The big monied real estate players know this real estate boom is long in the tooth and are raising money to buy up the distressed pieces when the time comes.

Even as a kid, Buffett was constantly making money, delivering papers and whatnot. Viewers won’t be surprised he was nerdy kid, good with numbers, bad at school, and awful with girls.