In 2017, the ongoing apartment building-boom in the US will set a new record: 346,000 new rental apartments in buildings with 50+ units are expected to hit the market,” three times the number of units that came on line in 2011.

All in Las Vegas Market

Sessions' Pot War is Up in Smoke in Nevada

Judging from the lines out the doors at dispensaries in just my neighborhood, I don’t doubt his projection. Even with it being a scorching 107 degrees this afternoon, Las Vegans were waiting patiently in the sun to go up in smoke.

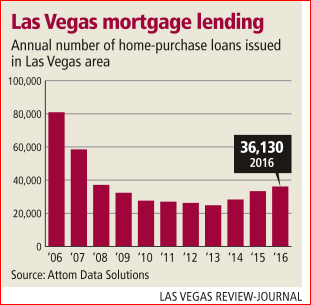

Las Vegas Housing: not exactly 2005....Yet

The real story is in the resale market where inventory is down to 1.7 months. “May’s resale closings (4,962) are the highest one month total that we have documented since the summer of 2005, 12 years ago,” write Dennis and Andrew Smith.

Bitcoin Mania Bypasses Las Vegas

"HowMuch.net on Wednesday put things into perspective and demonstrated that for all the buzz and excitement bitcoin has generated, it still has a long way to go to be even remotely relevant.

Real Estate President to 86 1031s?

It would indeed be ironic if Donald Trump of all Presidents would get behind 86ing 1031s.

Polish Maverick's Place Peddled Again

Eighth-grade graduate Bob Stupak had built the Stratosphere from nothing and $550 million from someone who couldn’t have been paying attention and opened in April 1996, at the time, the 3rd most expensive hotel-casino project in Las Vegas history. The self-proclaimed Polish Maverick was bankrupt three months later.

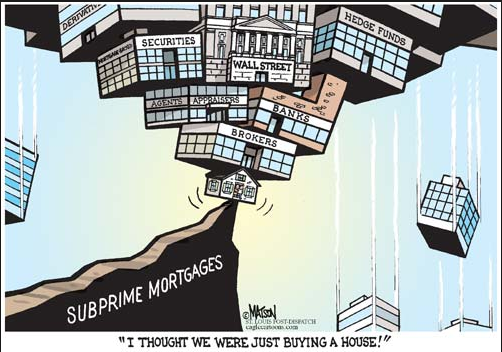

Help Wanted: Lenders with No Experience (or Short Memories) to Make Risky Mortgages

Of course there’s a good market for loans to folks who don’t fit in the Dodd-Frank box and lenders can earn 6% to 10% from borrowers sporting credit scores of 660 and below. But fresh-faced originators can’t figure out how to make the loans.

Flip It, Flip It Good

Las Vegas house flippers booked an average gross profit of $51,500 per deal in the first quarter. That’s up 29 percent from the same period last year and the biggest haul since at least early 2005

Up, up and Away, or Grinding to a Halt?

instead of leading the turn as they normally do, new home sales have lagged, both in time and quantity. A yawning gap has opened between the rate of growth in full time jobs, and the new home sales rate.”

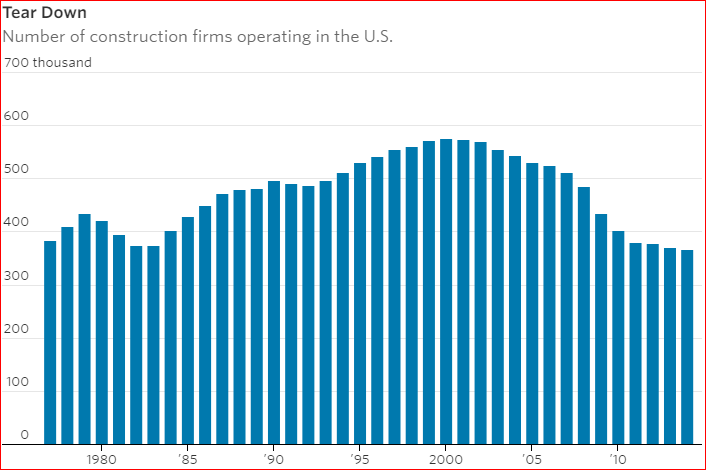

Shortage of Hammer Swingers

“Construction labor costs are rising an average of 4% to 5% annually, outpacing inflation, according to Anirban Basu, chief economist of the Associated Builders and Contractors. ‘The situation is going to get worse,’” he told Grant.

Sin City Cash Burning

The Vegas convention sweet spot on the calendar has come and gone and I figured that would be his explanation for the tepid market in rides. No, he said it's a supply problem. Too many drivers. He told me,

Less Supply = Higher Priced Homes

The shortage of supply, increases in costs, and millennials finally catching the home ownership bug has median prices jumping. Nationwide, “the median was $316,200 last year versus $240,900 in 2005.”

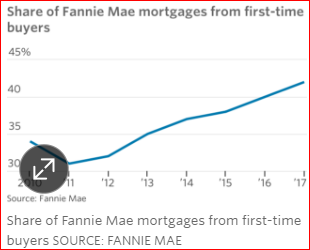

Millennials See White Picket Fences

“Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,”

Las Vegas Housing

The home market is still highly sensitive to interest rates. Employment/building permits is an interesting ratio that for the moment looks good, but could flip in a hurry.

No Need For Government Force Legal Pot Will Make Higher Wages

McCurdy should notice what’s going on in Denver. “Colorado’s restaurant labor market is in Defcon 5 right now, because of weed facilities,”

Big Boom and Big Bust, Jiggle Lives On

As John L. Smith wrote, “Few have enjoyed as much success combining skinny girls and whiskey as Jack Galardi.”

Trading Bad Paper Helps Underwater Homeowners

In the short term Gov’t Sachs is looking to satisfy its debt to society, but in the long run they think they can make some money at this.

Buyers Buy, When Lenders Lend

So why the rosy scenario? Americans figure the coast is clear, their jobs are safe, America is gonna be great again.

Las Vegas: Too Many Dealers, Too Much Bad Credit, Just the Right Number of Lawyers

Boohoohoo, we’re lightly burdened with Legislators at 11 percent, Urban regional planners at 42 percent, and Social scientists at 45 percent.

Turning Japanese, Again

Sumitomo Forestry wants more land to become "a leading homebuilder in the United States," with the goal of building 5,000 homes