Judging from the lines out the doors at dispensaries in just my neighborhood, I don’t doubt his projection. Even with it being a scorching 107 degrees this afternoon, Las Vegans were waiting patiently in the sun to go up in smoke.

All in Economics

Is Clooney Selling at the Top?

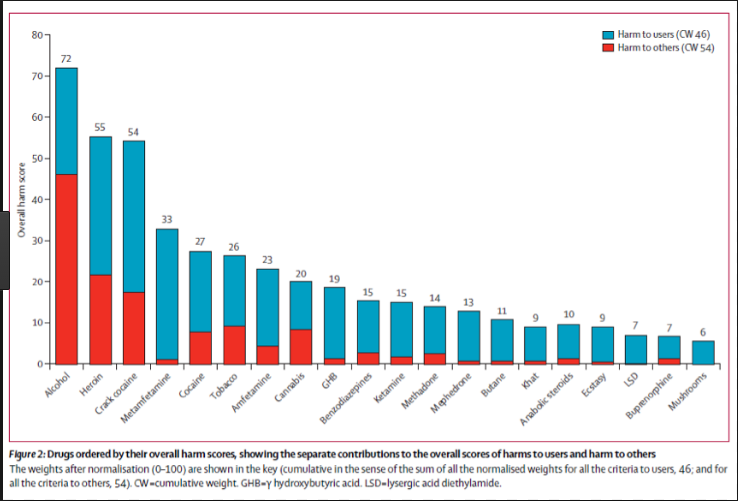

While Clooney and Co. cash in, Salon reports, “The legal weed market appears to be impacting booze’s bottom line.” Significant numbers of Millennials, Gen-Xers and Baby Boomers are switching from liquor to weed as it becomes legal.

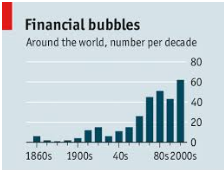

Yellen Says No More Financial Panics in Her Lifetime

Yellen follows in the footsteps of two great Fed Chair prognosticators.

Testosterone, the Austrian Business Cycle, and the Madness of Central Bankers

Are memories too short? Or testosterone too high?

Bubbles in Bond Land

The country’s Ministry of Finance figured their dodgy credit history would translate into offering an 8.25% yield, but demand was so strong the bonds sold at a 7.9% coupon. Memories are short

America's Troubles: The Boomers or Democracy?

"There is something wrong with the Boomers and there has been for a long time,” writes Gibney in the forward to A Generation of Sociopaths: How the Baby Boomers Betrayed America and the author’s beatings continue for 400 plus pages.

Bitcoin Mania Bypasses Las Vegas

"HowMuch.net on Wednesday put things into perspective and demonstrated that for all the buzz and excitement bitcoin has generated, it still has a long way to go to be even remotely relevant.

Richard Cantillon: Sleepless in Seattle

“there are currently 13 high-rise apartment or condo buildings of at least 24 stories in development or planning in the downtown area. The average is 39 stories. Another 24 high-rises are in the proposal pipeline, according to city and industry reports,”

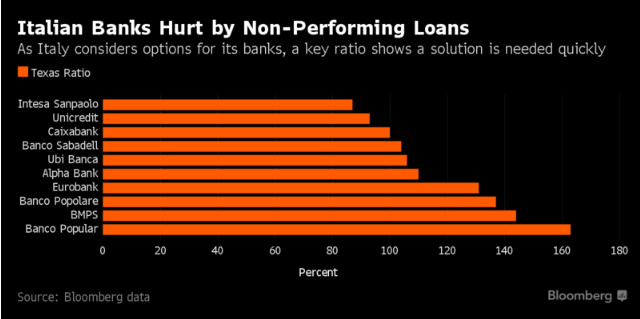

Italian Banking, Texas Style

“Italian finance officials and the European Commission are racing to find a solution for two troubled banks in the northern Veneto region that have weighed on the nation’s financial system.”

Real Estate President to 86 1031s?

It would indeed be ironic if Donald Trump of all Presidents would get behind 86ing 1031s.

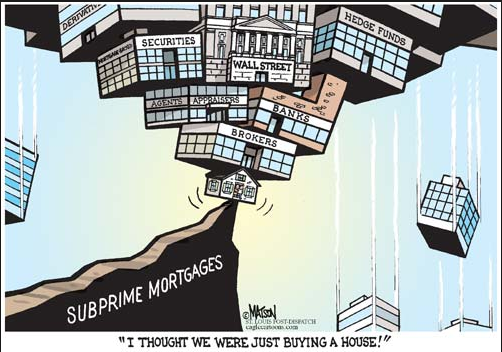

Help Wanted: Lenders with No Experience (or Short Memories) to Make Risky Mortgages

Of course there’s a good market for loans to folks who don’t fit in the Dodd-Frank box and lenders can earn 6% to 10% from borrowers sporting credit scores of 660 and below. But fresh-faced originators can’t figure out how to make the loans.

Tesla: Automobile Rent Seeker

After state government paid $43 million to brothel owner Lance Gilman for Tesla’s land and now has forked over another $59 million in transferrable tax credits, taxpayer have “invested” $214,000 in each $22.00/hour job.

Illinois Heads toward Bankruptcy, while Bankrupting its Citizens

Without legislative action, Illinois will be the Greece of the USA Zone after “Moody’s followed S&P’s downgrade Thursday, citing Illinois’s underfunded pensions and the record backlog of bills that are equivalent to about 40 percent of its operating budget.”

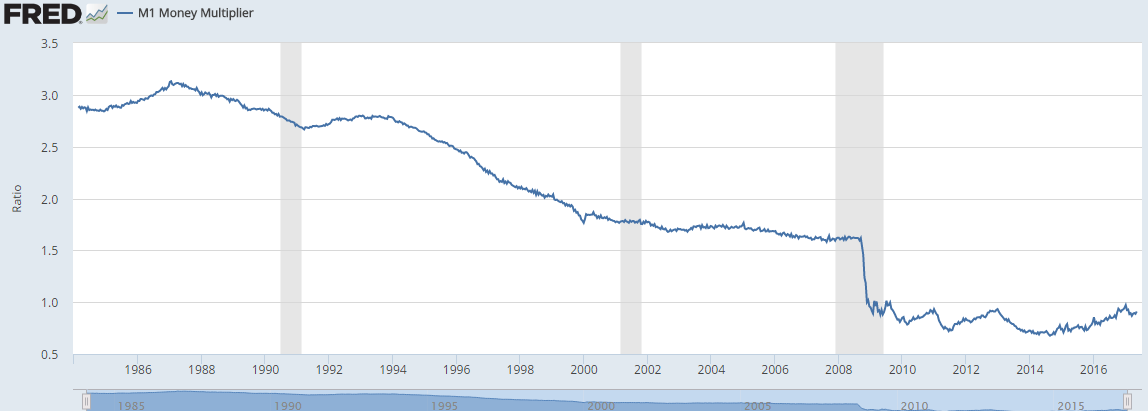

Credit now Repaired, Money will Multiply

An increase in lending might just kick start the money multiplier and then some honest-to-goodness, noticeable, government-can’t-deny-it price inflation might be just around the corner.

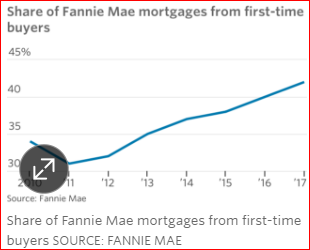

Millennials, You Don't Need No Stinking Down Payment.

The American dream of paying on a big fat, paycheck sucking and mobility stifling mortgage is just waiting for you. Take the plunge. Make America great.

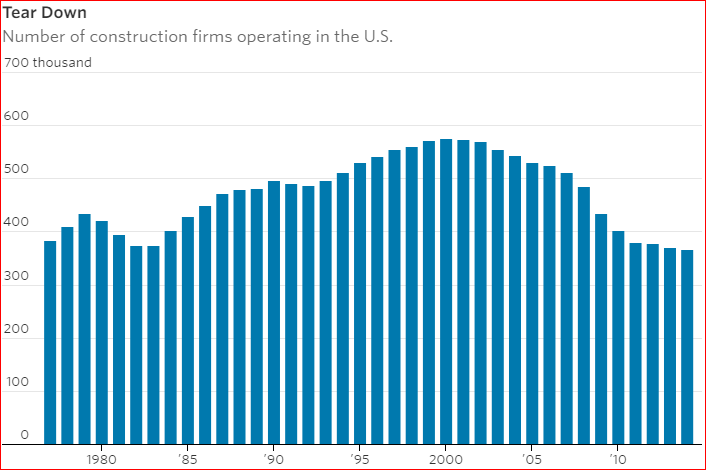

Shortage of Hammer Swingers

“Construction labor costs are rising an average of 4% to 5% annually, outpacing inflation, according to Anirban Basu, chief economist of the Associated Builders and Contractors. ‘The situation is going to get worse,’” he told Grant.

Sin City Cash Burning

The Vegas convention sweet spot on the calendar has come and gone and I figured that would be his explanation for the tepid market in rides. No, he said it's a supply problem. Too many drivers. He told me,

Less Supply = Higher Priced Homes

The shortage of supply, increases in costs, and millennials finally catching the home ownership bug has median prices jumping. Nationwide, “the median was $316,200 last year versus $240,900 in 2005.”

Millennials See White Picket Fences

“Virtually all major builders are migrating away from the luxury homes that dominated the early years of the economic expansion and are focusing on lower price points to cater to this burgeoning clientele,”

Bankers, the Last to Know

It seems Lord Keynes had one thing right when he wrote, “Banks and bankers are by nature blind. They have not seen what was coming…