BPO prices have fallen from $50 to $25, with one Indian company, AbVin Ventures LLP, offered to do the work for $10 a house.

All in Economics

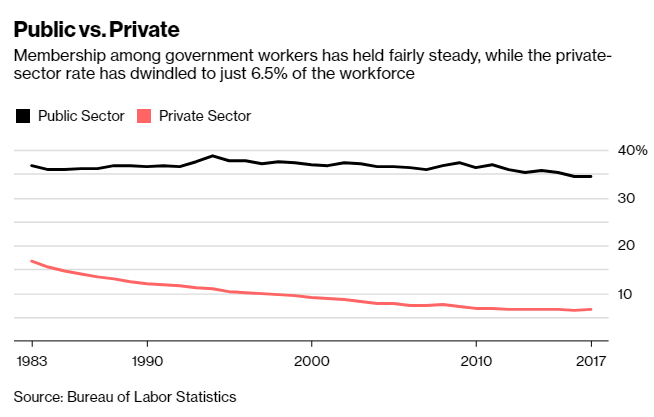

Government: Where Unions still Thrive and Steal

Not surprisingly, most of this wrongdoing involved Presidents and Secretary-Treasurers of local unions stealing from their own members. The thefts ranged from thousands to millions of dollars, with the thieves spending the money on cruises, tickets to Carrie Underwood and Sesame Street Live concerts.

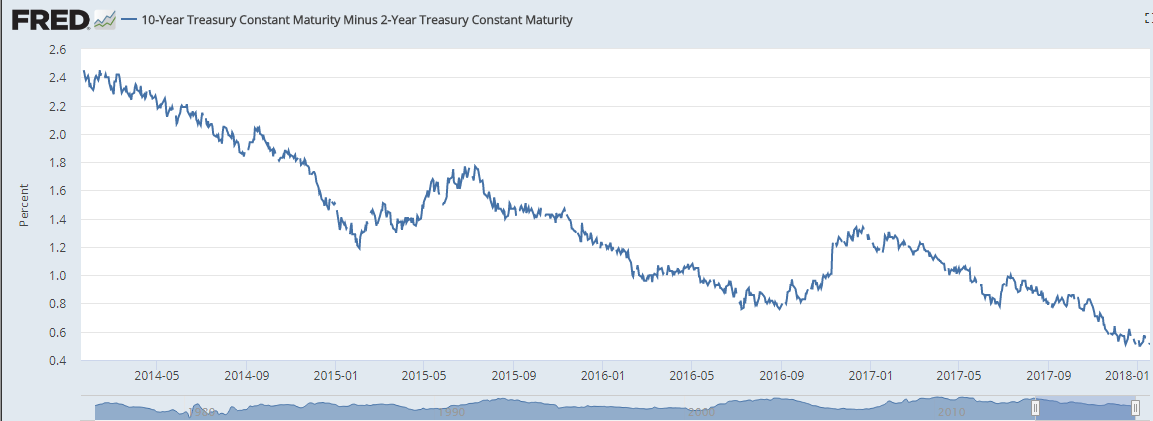

Uncle Sam's Paper is Downgraded

The way Beijing-based Dagong Global, a Chinese rating agency, sees it, Uncle Sam’s paper deserves, “a ‘negative outlook’ because of the US federal government’s declining capacity to repay debt, a situation worsened by tax cuts.”

Bitcoin Bugs become Gold Bugs

The current price swings across seemingly every cryptocurrency are bringing to the fore a question that has loomed over the industry since its inception: to what extent can a virtual asset be a store of value? By swapping out of digital gold and into the real thing, some investors may be providing an answer.

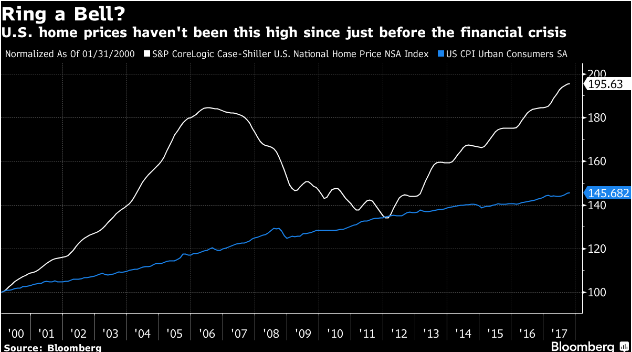

Trump Embraces the Bubble

Today was a dramatic day in some parts of Trump’s bubbleland, with Bitcoin closing at $10,124, down 25% for the day and a steep fall from $19,343 on December 19th. The DJIA broke 26,000 for the first time but closed lower, and the 2-year treasury note yield burst through 2 percent for the first time since the dark days of late 2007.

Bitcoin Obituaries Pile Up

So cryptos are not money. They are rather what has come from a consensual suspension of the laws against private-sector counterfeiting.

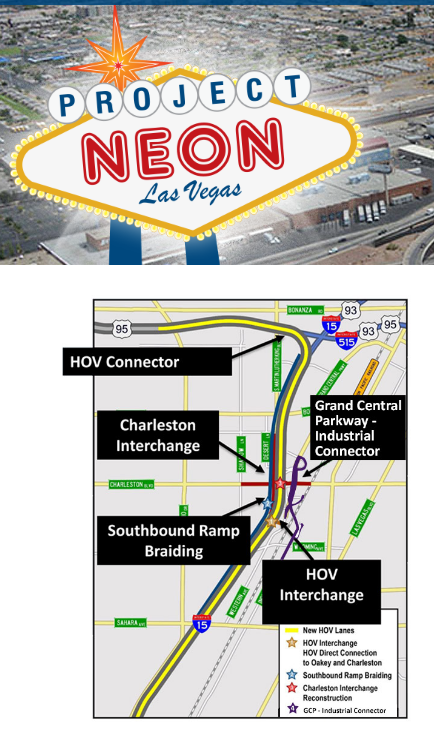

Sideways Skyscraper Curse

What those of us in Vegas are wondering (h.t. Jeff Barr); wouldn’t the skyscraper curse apply to large scale public works projects? The improvements are horizontal instead of vertical, but what happens at the end of massive highway infrastructure projects like the ones continuing in Las Vegas.

Newsletter Subscribers just wanna be Bitcoin Billionaires

In a word---Bitcoin, said Stansberry. Everything Stansberry sold last year had to have a bitcoin hook or angle to it. “We have to feed people the gruel they want,” he said.

The New American Way: Get High and Shop Online

This is a new segment of the industrial real estate market that is being created in front of our eyes,” George M. Stone, a longtime real estate executive now focused on the pot business told Gelles. “It’s a huge industry and only getting bigger.”

Trumpcoin!

So we have bitcoin, something everyone is talking about, but no one can see or understand, trading near $15,000 apiece. At the same time the President is like the simple-minded Chance in the movie “Being There” who has been educated only by television, has childlike naïveté, but rises, by accident, into the game of politics and the talk of the town.

Thank the Fed for Workamping

Bruder’s book is chalk full of sad stories of layoffs, foreclosures, and lack of family support. At the same time, these nomads, workampers or rubber tramps, are a resilient bunch, who left behind the costs and responsibilities of real estate for “wheelestate” to survive their golden years.

Tiny CAP rates, Massive Malinvestment

Grant wonders aloud during the podcast whether these central bank induced low rates are “perpetuating obsolete business models.”

Who's driving Bitcoin: Mrs. Watanabe, Millennials, & Teenage Whiz Kid.

Millennials are hoping Ronnie Moas is right. He said, "The end-game on bitcoin is that it will hit $300,000 to $400,000 in my opinion, and it will be the most valuable currency in the world," on CNBC's "The Rundown."

Popular Delusions: Markets, Musk, Murray and Bitcoin

The popular delusion being posited that Murray Rothbard is somehow the father of the alt-right and, “Rothbard, who died in 1995, would’ve loved Donald Trump, and he seems to have foreseen his rise as if in a dream,” wrote Justin Raimondo, is an attempt to make Murray the boogie man yet again.

Homeownership: Hoover's Government Subsidized Independence

The real nub of his argument is people should be encouraged to save and invest, not consume and take on years of debt. However, this continues to be the age of Keynesianism, where saving is bad, while consumption is good for the economy.

Mom and Pop Plunge into Bitcoin

But today on CNBC, Joseph Borg said, "We've seen mortgages being taken out to buy bitcoin. … People do credit cards, equity lines."

Hopelessness: Farmers Today, Pensioners Tomorrow?

What happened in Detroit is a harbinger of things to come. While state and local officials have their heads in the sand, “total unfunded pension liabilities have reached $3.85 trillion. That’s $434 billion more than last year. Amazingly, of that $3.85 trillion, only $1.38 trillion was recognized by state and local governments,” writes Oliver Garret for Forbes.

Millennials want Socialism to 'Get Ahead'

Ms. Garcia should have a look at Venezuela where socialism is starving its population. Three of every four people lost weight last year in a country that was once the fourth-richest per-capita in the world.

Cash Buyers and Liquidity Preference

“Economists said the decision to tie up so much liquidity in a home is puzzling at a time when mortgage rates are near all-time lows,” Laura Kusisto and Christina Rexrode for the Wall Street Journal. But then again, most economists are Keynesians.

NFL's Problem is Poor Product, not Disrespect

Trump may have made some political hay out of all this, but one only has to follow the money to learn the real reason pro football ratings are down--competition from college football. The fact is, “Their product isn’t very good these days,” Nick Bogdanovich told the Las Vegas Sun